latest news and updates

On this page you can find useful information that can help you stay up to date on global mobility, tax and other relevant things. We have also categorised our various articles so that it is easy to find the knowledge you are looking for. We post regularly, so remember to check in to stay updated.

We went to Make Waves

Our very Linda and Line attended the Make Wave ’23 event in Munich to, as the event organiser puts it: “hear from expert speakers, meet fellow Make users to engage, learn, and discover new best practices“.

10 Billion DKK tax break proposed

The Danish government has proposed a tax reform, which will give a tax break of 10 billion Danish Kroner (DKK) to 3.3 million Danes from 2026. The reform has also introduced a new “top-top-tax” for people with an annual income of more than 2.5 million DKK.

“Succesvirksomhed” 2023

Crossbord has been awarded the prestigeous Succesvirksomhed 2023 (success corporation) based on our performance in the recent five years.

TIN a requirement in all Payroll Reporting to the Danish Tax agency

From January 1st, 2024, payroll reports to the Danish Tax Agency (Skattestyrelsen) must include TIN for all income recipients abroad, regardless of EU residency.

Danish High Court’s Verdict on Cross-Border Severance Payment Taxation

A recent Danish High Court verdict sets a new standard for taxing international severance payments. The ruling impacts both individual taxpayers and multinational companies in Denmark, clarifying how Danish tax laws intersect with double taxation treaties, particularly with China.

Tender for Danish Energy Island postponed

The intention to provide the tendering material for the North Sea Energy Island before the summer holiday has been cancelled.

The basis for foreign property tax

The Danish Tax Authorities have just made an announcement regarding the determination of the basis for foreign property taxation for the income year 2022

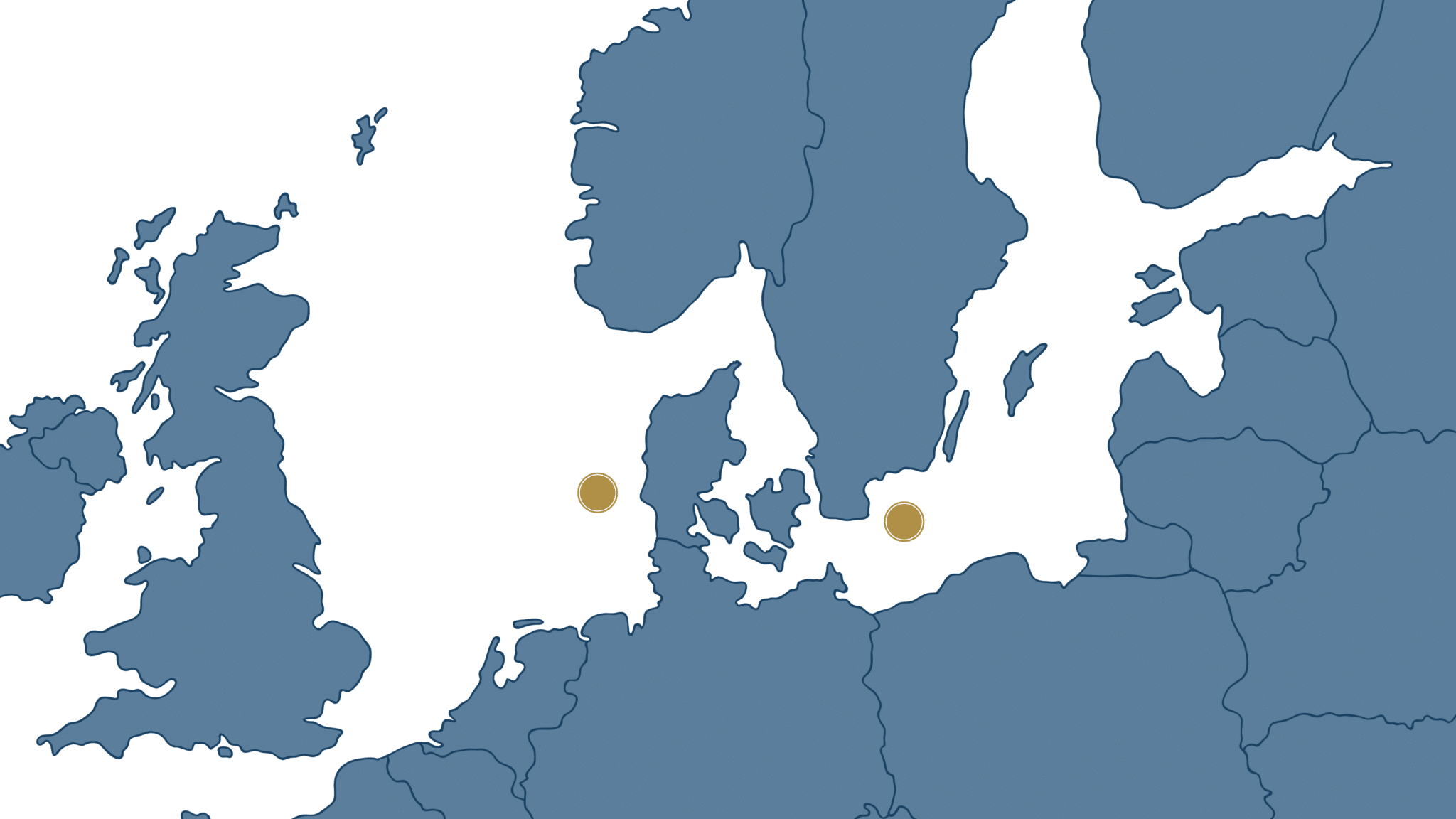

Energy Islands: Taxation of individuals

Denmark is constructing a number of Energy Islands, which will serve as hubs for green energy manufacturing and distribution. Denmark’s exclusive economic zone has been expanded as a consequence. Read more about how this will affect taxation of individuals here.

Energy islands: The introduced taxation in brief

The construction of two energy islands off the coast of Denmark has caused several new tax liabilities to be introduced for the activities performed in relation to this. Read more about the introduced taxation and get the highlights here.