HOW TO REPORT eINCOME (eINDKOMST) CORRECTLY

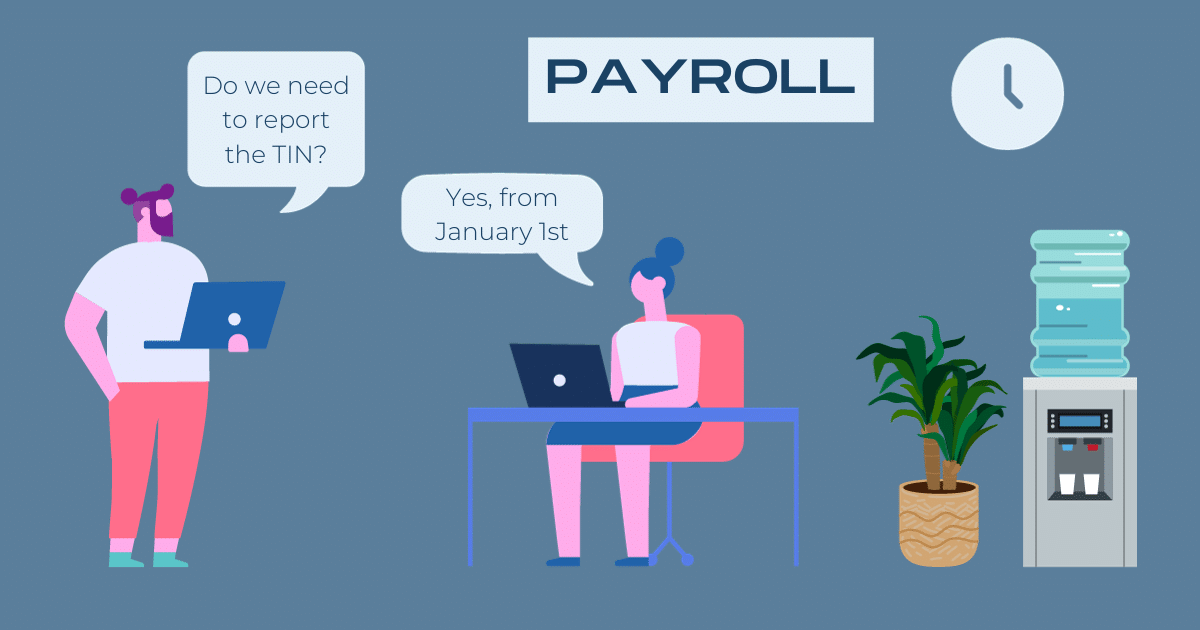

Starting from January 1st, 2024, it will become a requirement to report the TIN (Taxpayer Identification Number) in all payroll reports to the Danish Tax Agency (“Skattestyrelsen”) for income recipients residing outside of Denmark (regardless of whether the employee is a resident of a country in the EU or not).

The TIN obligation applies to salary reports with a pay period ending on or after January 1st, 2024. The TIN is issued by the employee’s country of residence, and it is the employer’s responsibility to obtain the TIN from the employee.

If a reported TIN does not meet the specified format requirements for the respective country code, the reporting party will be notified, but the payroll report will eventually be rejected, if submissions either lack TIN information or where the included TINs do not conform to the required formatting standards.

We expect that the demand for accurate TIN reporting will intensify in the coming years; however, there will be a grace period, where the reports will not be rejected.

What is a TIN number?

TIN is an abbreviation for Taxpayer Identification Number.

Often the extra “number” sneaks in, when we say it out loud, and yes that means that we actually say “Taxpayer Identification Number Number”.

In Denmark the TIN equals the CPR number (Central Person Registration), which is a personal identification number or civil registration number.

In situations where a person is not a resident in Denmark but is still taxable to Denmark, for example as an employee, the Danish Custom and Tax Administration can issue a CPR number.

For whom do the new rules apply?

The rules apply to all employees who reside outside of Denmark. This means that it does not matter whether the employee is a resident of an EU country aside from Denmark or a resident of a non-EU country.

In practice, TIN must reported for all employees, who are not a resident of Denmark as of January 1st, 2024. The Danish Tax Agency will verify the residency of each employee based on the CPR registry (CPR-registeret).

Employee living and

working in Denmark

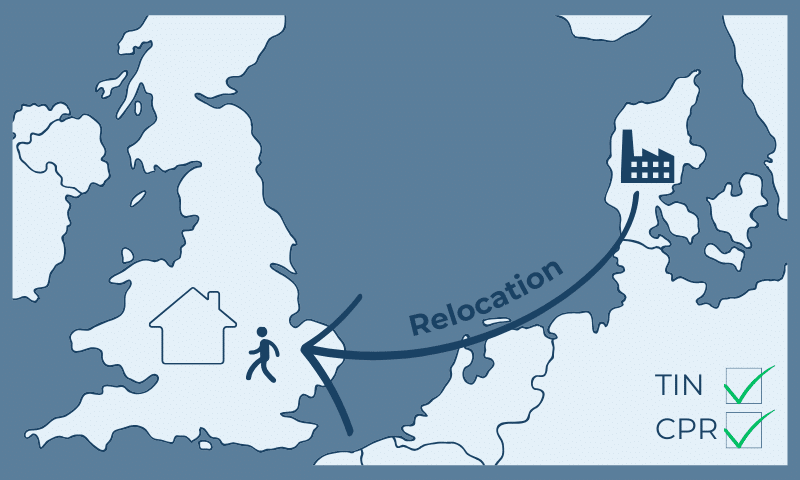

Employee Relocated

Outside of Denmark

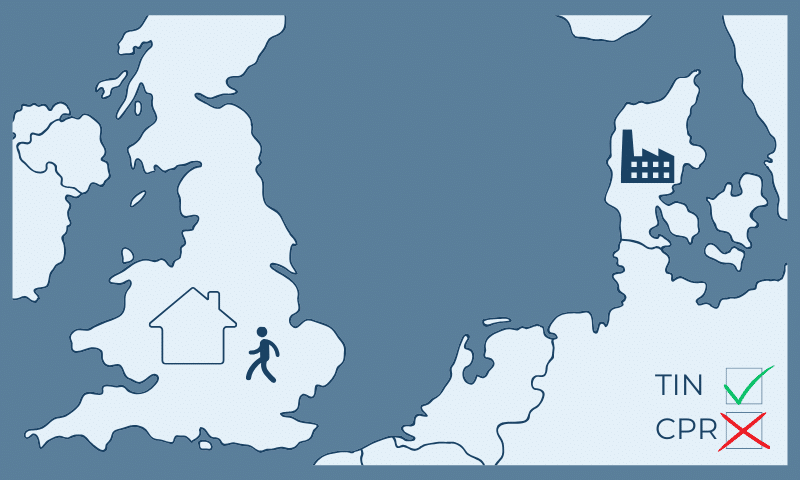

Non Danish Employee Living and

Working Outside of Denmark

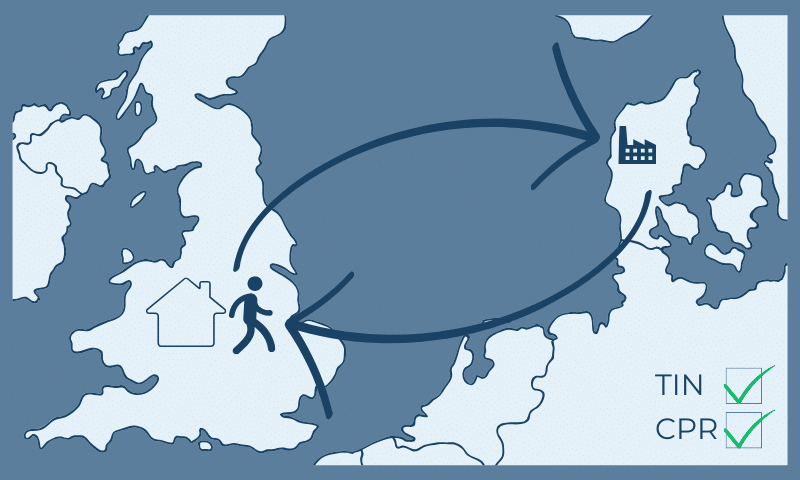

Employee commuting to

and from Denmark

Danish payroll & Non-Danish residents

For all employees in scope, a process for obtaining and verifying valid TIN must be introduced if the information is not already kept as part of the employee onboarding. Furthermore, the payroll process must reflect a verification of whether a payroll report is demanding a TIN report or not.

will payroll reports be rejected?

Currently, the Danish Tax Agency will not reject any reports; however, starting from September 2023, reports with incorrect TIN will be registered as a report with a potential error (a so-called Advis).

Let us help you

Crossbord consultants participate as experts in status meetings held by the Danish Tax Agency. Here new and upcoming changes to the payroll reporting requirements are discussed.

Operating a Danish payroll with employees residing outside of Denmark is (often) complex, and demands great insights by the team responsible for the payroll process. It demands a keen focus on international employment tax rules, international social security rules, and for the payroll team to be involved with other business areas to understand how the activities of the business and the residences of the employees are co-dependent. The TIN reporting requirement adds a further layer of complexity.

At Crossbord, we are experts in payroll processing and tax reconciliation for international employees, and we are available to assist with all aspects of a complex payroll process:

- Analysis of how to setup the payroll processes, especially where your employees have a complex setup

- Assisting with guidelines on how to monitor key aspects

- Outsourcing of payroll (fully or partially)

- Providing support to third-party payroll providers

Write a short comment about your issue below,

and one of our consultants will be in contact with you shortly.

Or book a meeting with one of our consultants.

Get assistance

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.

official communication in october

The Danish Tax Agency is expected to issue a general update on their website (www.skat.dk) and provide a communication package for various organisations and authorities in mid October 2023. Finally, the reporting guidelines will be updated at the end of October 2023.

Further information:

- TIN online check module by the European Commission

- Retsinformation: Bekendtgørelse om ændring af bekendtgørelse om et indkomstregister (in Danish)

- Den Europæiske Unions Tidende: RÅDETS DIREKTIV (EU) 2021/514 (in Danish)

- OECD TIN page with definition on all countries' TIN-numbers (part of the exchange portal)

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord