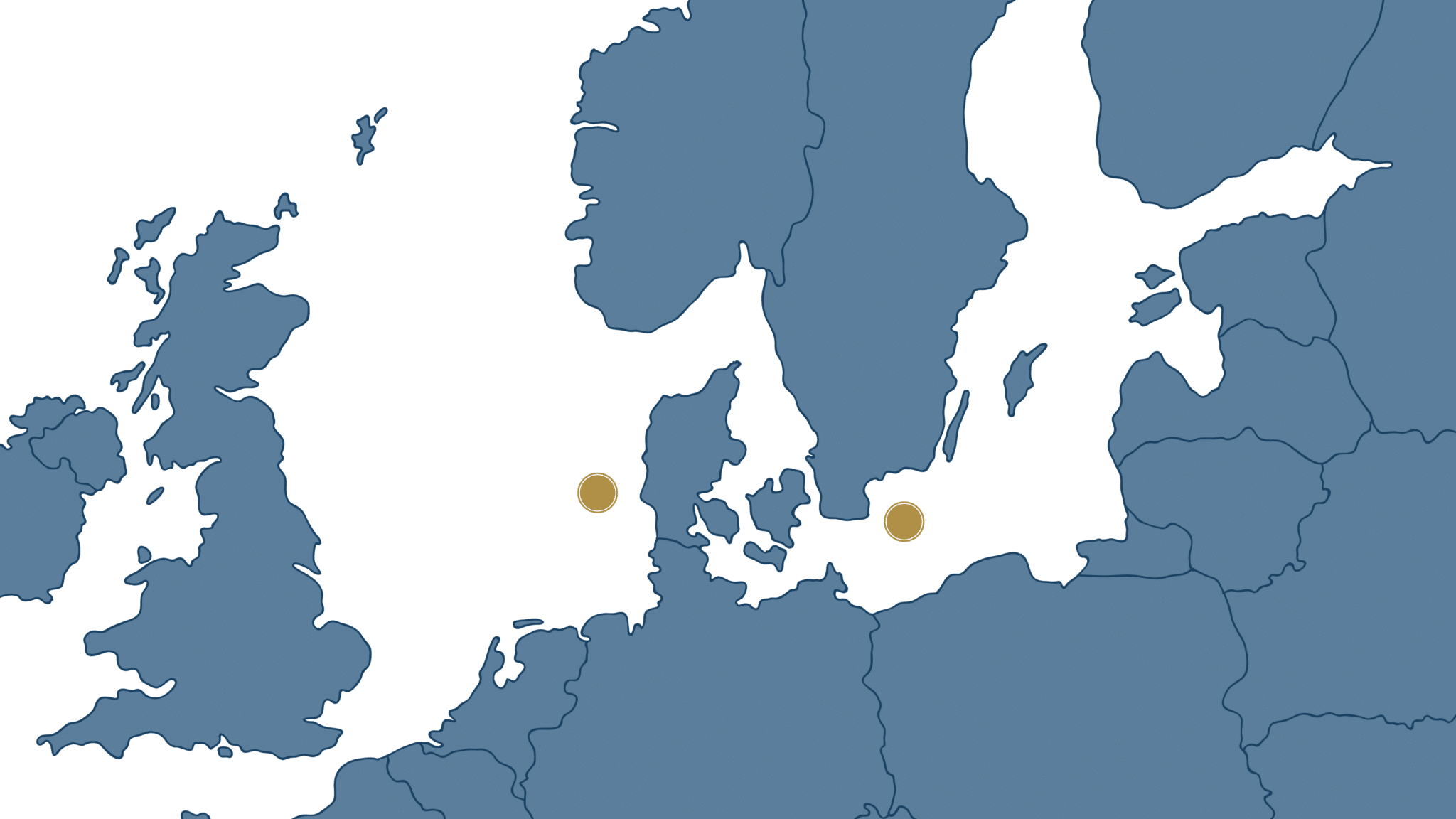

A project to build two energy islands in Denmark, the largest construction project in Danish history to date, have been greenlit by the Danish government, one in the North Sea, and in the Baltic Sea. Read more about the Danish energy islands in general, the taxation of individuals, or compliance and taxation in regards to the energy islands.

The introduced taxation in brief

Several new tax liabilities have been introduced for the activities performed in related to the construction, usage and operation of the energy islands, installations, and facilities:

- Limited corporate taxation via permanent establishment (PE)

- Limited individual taxation, which can be present if…

- The employer is resident in Denmark, or

- The employee is working for a permanent establishment, or

- The individual spends more than 183 days in a 12-months period in Denmark (including the special economic zone)

- Limited individual taxation in the event of hiring-out labour

In terms of computing the taxable income and the taxes payable, the standard Danish rules are to be followed, with some introduced amendments related to hydrocarbon taxation in regard to storage of CO2.

Permanent Establishment

The Corporate Taxation Act has been amended with a definition on permanent establishment, which is (our translation):

“Permanent establishment according to subsection 1, letter a, also includes activities carried out through a fixed place of business in Denmark’s exclusive economic zone, when the activities in question relate to the establishment, operation and use of artificial islands, installations and facilities. 3rd point however, only applies to activities relating to cables and pipelines which continue into Denmark’s land or sea territory or are related to exploration or exploitation of the resources of the Danish continental shelf or the operation of artificial islands, installations, and facilities on the Danish continental shelf.”

The amendment is found under the specific articles on construction Permanent establishment (PE), where Denmark applies a legislative understanding that a PE is present from day 1. The activities that lead to the presence of PE should therefore be taxed on arm’s length similar to how PE’s are generally taxed. It is noteworthy that the definition of PE is to be understood broadly. The definition is however limited in regard to cables and pipelines.

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord