Crossbord: Your Tax Expert for All Employee Assignments

Stay compliant, manage your global workforce, and navigate your cross-border (re)organisations with ease.

Our services provide you with expert knowledge on Danish territory-specific laws regarding tax, payroll, HR, global mobility and compliance – delivered with excellent communication skills.

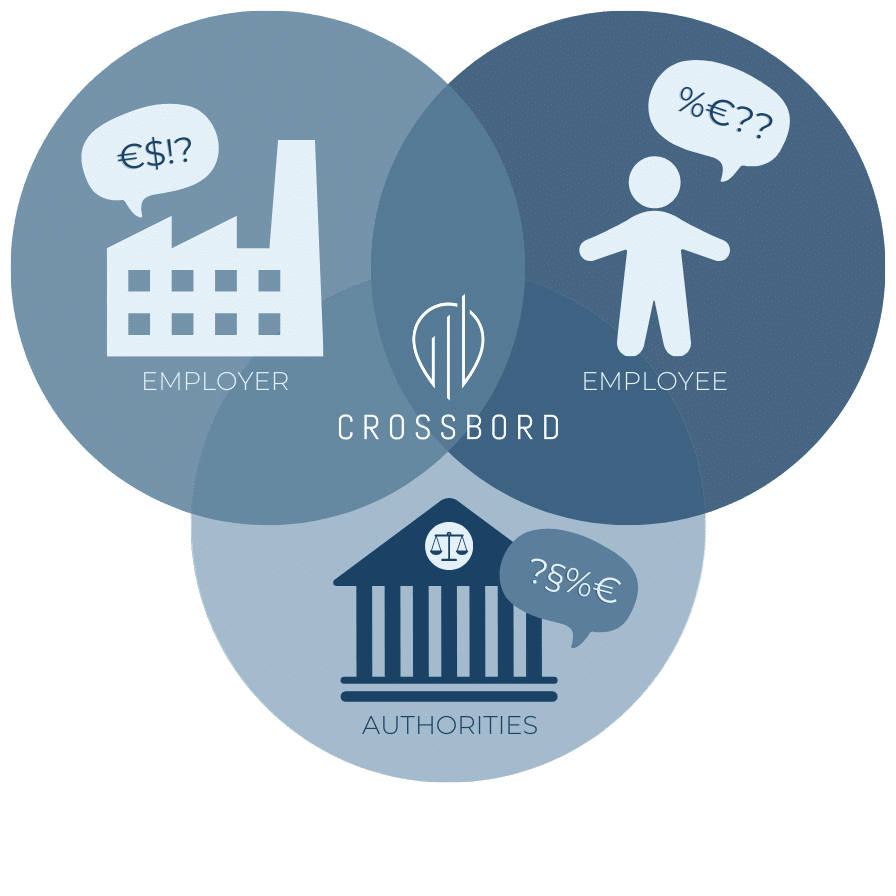

Your link to the local authorities

We provide international tax and so much more, and we understand that international tax, compliance, and the process of establishing payroll can be complex, and sometimes confusing, endeavors.

The setup of these might leave one with even more questions regarding the management of global mobility into or out of Denmark.

Crossbord cooperates with your in-house team to facilitate seamless communication between local authorities, employers, and employees, aiming to simplify these interactions.

Our approach begins with a comprehensive understanding of your unique circumstances, and besides offering recommendations on which actions to take, we take a step further and assume responsibility on your behalf.

Our extensive expertise and dedicated knowledge in this field ensure that both employees and employers can place their trust in us to handle tax-related matters.

By doing so, you can comfortably shift your focus towards what truly matters to you.

✔ Fast response time ✔ Most recent expert knowledge ✔ Reliable and proactive collaboration ✔ Accessible and competent guidance ✔ Save resources and secure compliance

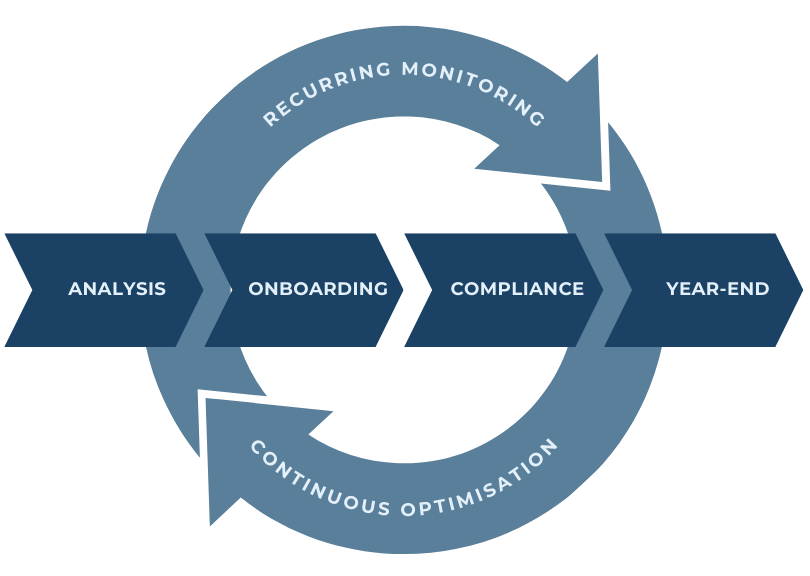

The Crossbord Method

Keep the end user in mind. Analyse, process, and review. Repeat.

Our ultimate goal is to ensure that the end user, your employee, feels safe in the process. At the same time you, the employer, can enjoy the benefits of ease and knowing that you compliance is up to par.

Our approach centers around connecting the dots between you, your employees, and the authorities. Our method is starts with an analysis, then moves to processing, and finally results in a review.

Analysis

- Tax positions

- Compliance Requirements

- Identification of Data Needed

Process

- Onboarding Conclusions

- Payroll

- Monthly Review

- Recurring Process

- Year-End settlement

Review

Review and feedback on process and resources included

The Crossbord® Solution

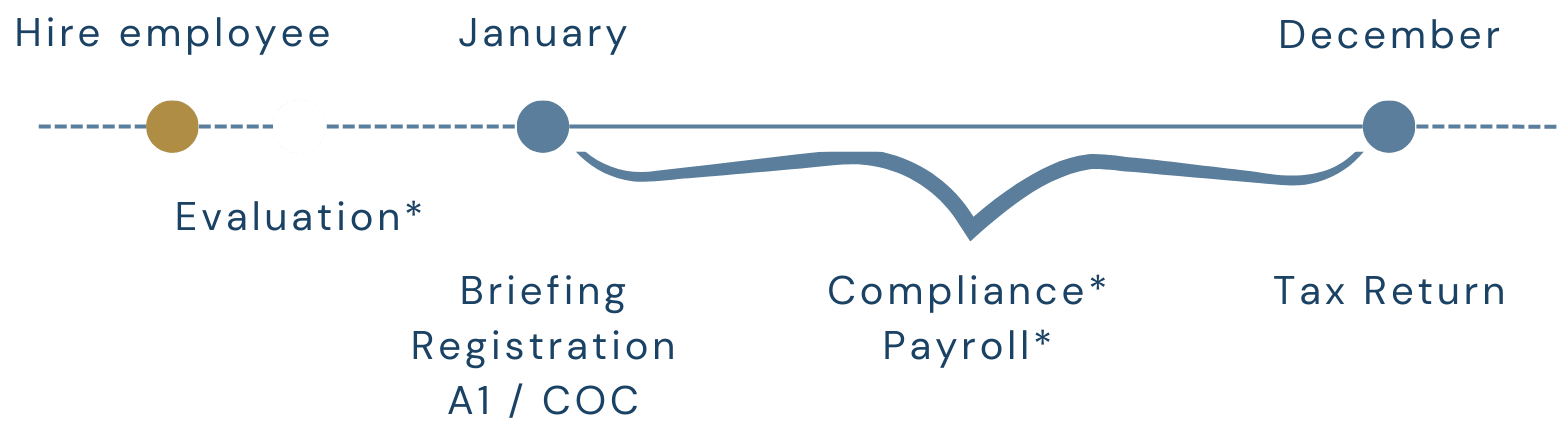

The Crossbord® Solution takes point of departure in our methodology in an iterative manner; for each case or employee we start with an analysis of tax positions, compliance requirements, and identification of which data is needed.

Following the analysis, we go through a thorough onboarding process and ensure compliance, this is typically an iterative process, where we receive information and can, therefore, execute or warn the stakeholders in real time avoiding any unfortunate situations or escalations.

Finally, the process iteration concludes with the year-end reconciliation for which we have collected the data throughout the year.

* Price on request

Our clients love our process due to the ease of execution and the mental safety that comes with not having to worry about collecting all data at one time, and the possible late fees or penalties that might incur from not adjusting data in real time.

Testimonials

You get expert knowledge

As cross-border tax experts, we can help your business with everything related to tax, payroll, HR, global mobility, and advisory services.

We make sure your business stays compliant. We don’t just provide you with recommendations for you to implement, we get involved and do the work for you.

Our expert knowledge and experience across countries and industries allows you to save internal resources, create peace of mind for your company and your employees, get answers to legal questions, get professional payroll and a simple process for otherwise complicated cross-border tasks.

Stay updated - stay compliant

See the latest news relevant to global workforce management

Property Value Tax for Overseas Properties in 2024

If you own a property abroad, in the Faroe Islands, or in Greenland, and are also liable to pay tax in Denmark, you must pay

Crossbord gives tax seminar

The Danish year end tax statement can be quite confusing even to Danes, so while it is now availble in English for foreigner, it can

Tax Seminar for Internationals in Aalborg

The year-end statement (årsopgørelse) is now available in English, making it easier for non-Danish speakers to review and correct their tax information. However, certain elements-such

Industries we work with

Our team of experts provide a wealth of industry-specific insights and experience with tax, HR and payroll within the following sectors to name a few.

As our expertise extends beyond these industries we are able to assist clients across sectors, ensuring compliance with ever-evolving regulations.

- Shipping

- Oil / Gas

- Tech

- Finance

- Production

- Aero / Air Mobility

- External Advisors

- And more…

Meet our experts

Collaborating closely with your in-house team, our delivery team will provide tailored solutions that align with your unique requirements.

Trust in our team members’ individual expertise to ensure compliance, streamline processes, and optimise efficiency

– empowering your organisation to thrive in the global market.

MAKE GLOBAL MOBILITY EASY

FOR YOU AND YOUR EMPLOYEES

What about United Tax Network - Denmark?

The world is changing, so are we. Becoming Crossbord is a natural progression for us to continue to meet the demands of an increasingly complex market at an excellent standard.

Since 2006 United Tax Network – Denmark has delivered good solutions that our clients already know and rely on, and we will continue to do so in the future as Crossbord.

And we are still a member of United Tax Network Worldwide.