The projects specifically cover six new offshore wind farms. Companies can bid on the projects already now, if they wish to establish offshore wind parks in the designated areas at Krigers Flak, Hesselø, the North Sea and Kattegat. The goal is for the offshore wind parks to be completed by 2030.

We’ve previously written about the Danish government’s ambitious plan for offshore wind farms, how it was then postponed, and then seemingly abandoned. However, this Monday (22/04/2024) the government has released the news that 6 offshore farms have been put up for tender (Klima-, Energi- og Forsyningsministeriet).

The government expects the price of establishing an offshore wind farm to be in the area of 16 billion Danish Kroner (2.14 billion Euro), and the government has asked that in the application the companies specify the size of the annual fixed amount they will offer to the state over 30 years for the right to use the marine area.

Furthermore, the government has decided that the projects will not receive state support, and that the state will purchase a 20 percent ownership stake in each offshore wind farm.

Read more about the the introduced taxation for the Energy Islands in brief, how to navigate compliance and taxation for the Energy Islands, and how taxation of individuals in connection with the Energy Islands will work.

8 critical considerations

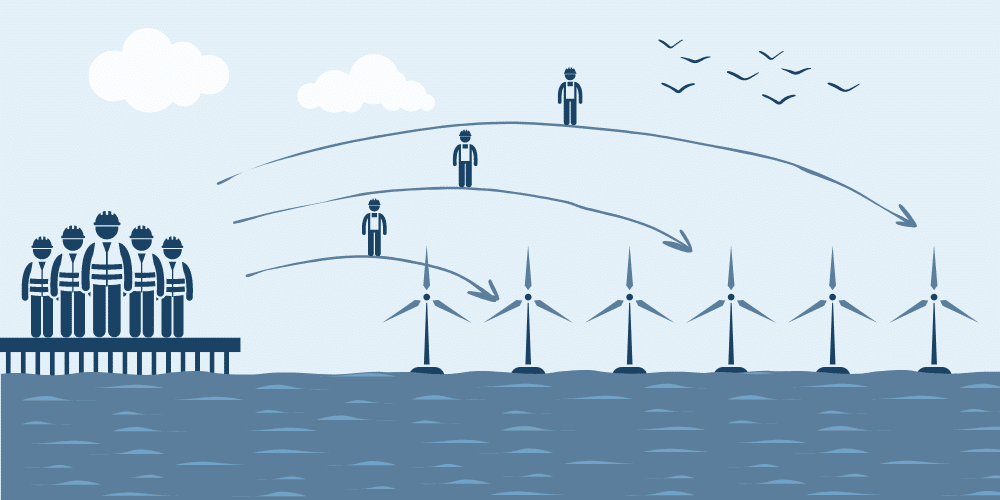

Companies must diligently research and comply with the tax laws of each country where their projects are located, taking advantage of tax benefits and incentives while ensuring all tax liabilities are minimised across jurisdictions. Denmark applies a vast range of tax regimes, including tax liability for companies and employees when the projects are related to offshore wind farms in Denmark.

Designing payroll systems that align with various national tax systems and employment laws is crucial. This ensures employees are paid correctly, and on time, with accurate deductions, and remittances made as required. In Denmark, settling taxes related to employment income is often the responsibility of the employer and, therefore, a compliant payroll setup is crucial.

Managing currency risks through financial strategies, such as forward contracts or options, is necessary to protect against currency fluctuations. Effective financial planning ensures that the business remains stable across different currency zones.

Companies need to leverage double tax treaties to avoid paying tax twice on the same income, as well as avoiding additional expenses on the employment income for their employees. Proper understanding and application of these agreements can significantly reduce the overall tax burden.

When establishing a company in Denmark, it is important to first identify if the operation shall be commenced through an establishment in Denmark or via a non-Danish entity. Setting up subsidiaries or branches involves complying with local corporate laws, which vary in terms of registration requirements, capitalisation, and business practices. Depending on the project, a non-Danish entity may be obligated to follow the same requirements as a Danish establishment.

It is crucial to ensure compliance with EU Regulation 883/2004, Articles 11-16, which governs social security for employees working across multiple EU countries. This regulation specifies that an employee should be covered by the social security system of only one Member State to avoid dual contributions and ensure continuous coverage. Particularly, companies must determine if employees should be affiliated with the social security system of the country where they work, their country of residence, or where the employer is based, depending on their work arrangements and mobility. This careful alignment is essential for maintaining legal compliance, and safeguarding employee benefits across different nations.

Adherence to the EU Posted Workers Directive is crucial for ensuring that the rights of employees stationed in other EU member states for specific projects, such as offshore wind farms, are protected. This directive mandates that posted workers must be granted the same working conditions and pay as local employees in the host country, including minimum wage rates, maximum work periods, and health and safety requirements. Companies must rigorously comply with this directive to safeguard workers’ rights and ensure equal treatment while managing cross-border employee deployments effectively. Compliance not only prevents legal issues but also promotes a fair and ethical work environment across all project locations.

Correct work permits and visas is essential for staff who need to move between countries. Companies must understand each country’s immigration laws, and ensure timely submissions to avoid project delays. Denmark offers several schemes for obtaining work permits like The Pay Limit Scheme, Fast Track Scheme, and the Specialist Scheme.

Addressing these considerations with meticulous planning before strategic implementation will enhance operational effectiveness and uphold your company’s reputation in the competitive field of offshore wind energy. The Crossbord(r) Solution offers assistance with regulatory requirements, registation of projects and/or employees, and adherence to double tax treaties as part of a compliant payroll operation.