a tax return free society

The concept of a tax return free society has been in development for many years, and Denmark is at the forefront of making it a reality. The goal is to eliminate the need for individual taxpayers to submit tax returns manually, thereby reducing errors and ensuring compliance through direct employer reporting. The vision primarily targets individuals with straightforward income streams, where payroll systems play a crucial role in ensuring accuracy and timeliness in reporting.

How payroll facilitates compliance

Payroll systems are integral to this new vision as they automate the process of collecting and submitting income data to tax authorities. Employers are responsible for reporting all relevant income details, which are then automatically reflected in the individual’s tax assessment (årsopgørelse). This reduces the risk of discrepancies and ensures that employees do not have to manually file their income details, aligning with Denmark’s vision of minimizing individual administrative tasks.

Implications for global mobility

For employees who work across borders, particularly those with Danish employers or foreign employers with a permanent establishment in Denmark, payroll’s role becomes even more critical. The shift means that income derived from work performed in Denmark must be reported by the employer. This change simplifies the tax process for expatriates and cross-border workers, who can rely on their employers to manage tax reporting obligations accurately.

- Employer compliance and responsibility: Employers must understand and adhere to Danish payroll regulations to ensure compliance. This involves timely and accurate reporting of wages, taxes withheld, and other relevant financial data.

- Reduction in administrative burden: By eliminating the need for individuals to file traditional tax returns, the new system significantly reduces the paperwork and potential for errors in tax filings. It also streamlines processes for expatriates, who may previously have faced complex tax filing requirements in multiple jurisdictions.

Reporting foreign income and assets

While the new system covers income reported by employers, individuals must still report certain types of income and assets:

- Income not subject to reporting by employers: Income from foreign employers without a permanent establishment in Denmark must be self-reported. This ensures that all global income is appropriately taxed.

- Foreign real estate: Ownership of foreign real estate must be disclosed, including any income derived from it, such as rental income.

- Investments and securities: Individuals must report income or gains from foreign investments, such as dividends or capital gains from stocks, which are not automatically reported by foreign financial institutions.

- Tax relief of foreign income: Settling taxes in Denmark with tax liabilities in several jurisdictions require a tax return. (Read more about tax returns in Denmark)

These reporting obligations highlight the continued need for individuals to be proactive in ensuring their tax information is complete and accurate, particularly when dealing with complex tax positions dealing with several tax jurisdictions at the same time.

Benefits of direct employer reporting

The transition to employer-reported income offers several benefits for employers with a global work-force:

- Efficiency and accuracy: Automated payroll systems reduce the likelihood of errors in income reporting, ensuring more accurate tax assessments and reducing the administration and costs for tax return support.

- Transparency and simplification: Employees receive a clear overview of their tax obligations through their tax assessment notices, eliminating confusion and simplifying financial planning.

- Improved focus: By applying the proper payroll reporting, even complex scenarios with several tax and social security jurisdictions can be managed.

- Data sharing: Starting 2024, TIN is a requirement on all payroll reporting in Denmark and the Danish Tax Agency is (generally) sharing information with tax authorities in other tax jurisdictions. (Read more about TIN)

Challenges and considerations

Despite the advantages, the new system requires robust payroll processes and understanding of local tax laws by employers. Companies must invest in training and technology to manage payroll functions effectively as the traditional payroll service effectively functions as the tax advisor for the employees. This is especially complicated when dealing with several tax jurisdiction and inbound expats. Additionally, there is a need for ongoing dialogue between employers, employees, and tax authorities to settle income and taxes.

Conclusion: The Crossbord Solution

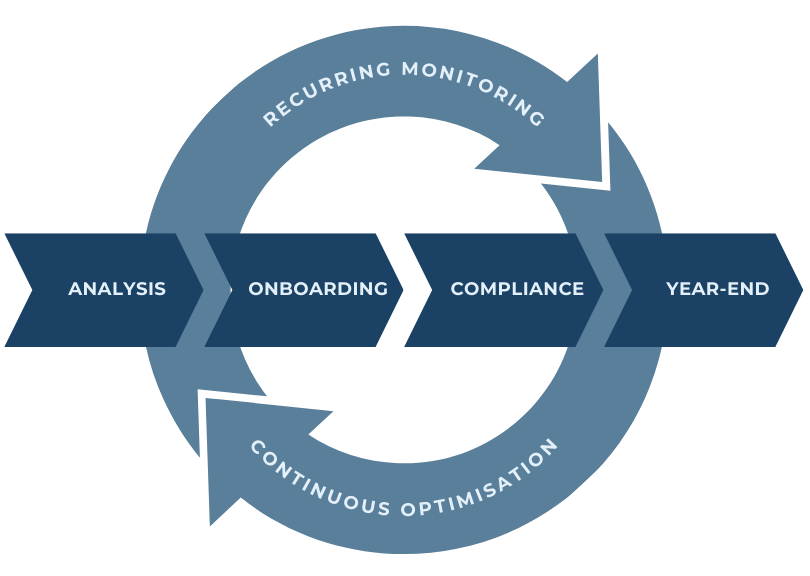

The Crossbord Solution provides a comprehensive approach to managing global mobility and payroll challenges in Denmark. By offering integrated payroll and tax compliance services, it ensures that foreign employees working for Danish employers or companies with a permanent establishment in Denmark have their income accurately reported and taxed.

The Crossbord Solution acts as a vital link between employers, employees, and tax authorities, streamlining the process and eliminating the need for individual tax returns. This approach not only enhances compliance but also simplifies the management of international assignments, setting a benchmark for effective global mobility solutions.