The economy needs a review as the Danish state stands to spend upwards of DKK 50 billion (EUR 6,71 | USD 7,35 | GBP 5,75). This renders the project unprofitable and, thereby, it fails to meet one of the requirements in the political agreement.

The minister of Climate, Energy and Utilities, Lars Aagaard, explains the reason why the tender for the Danish Energy Island is postponed:

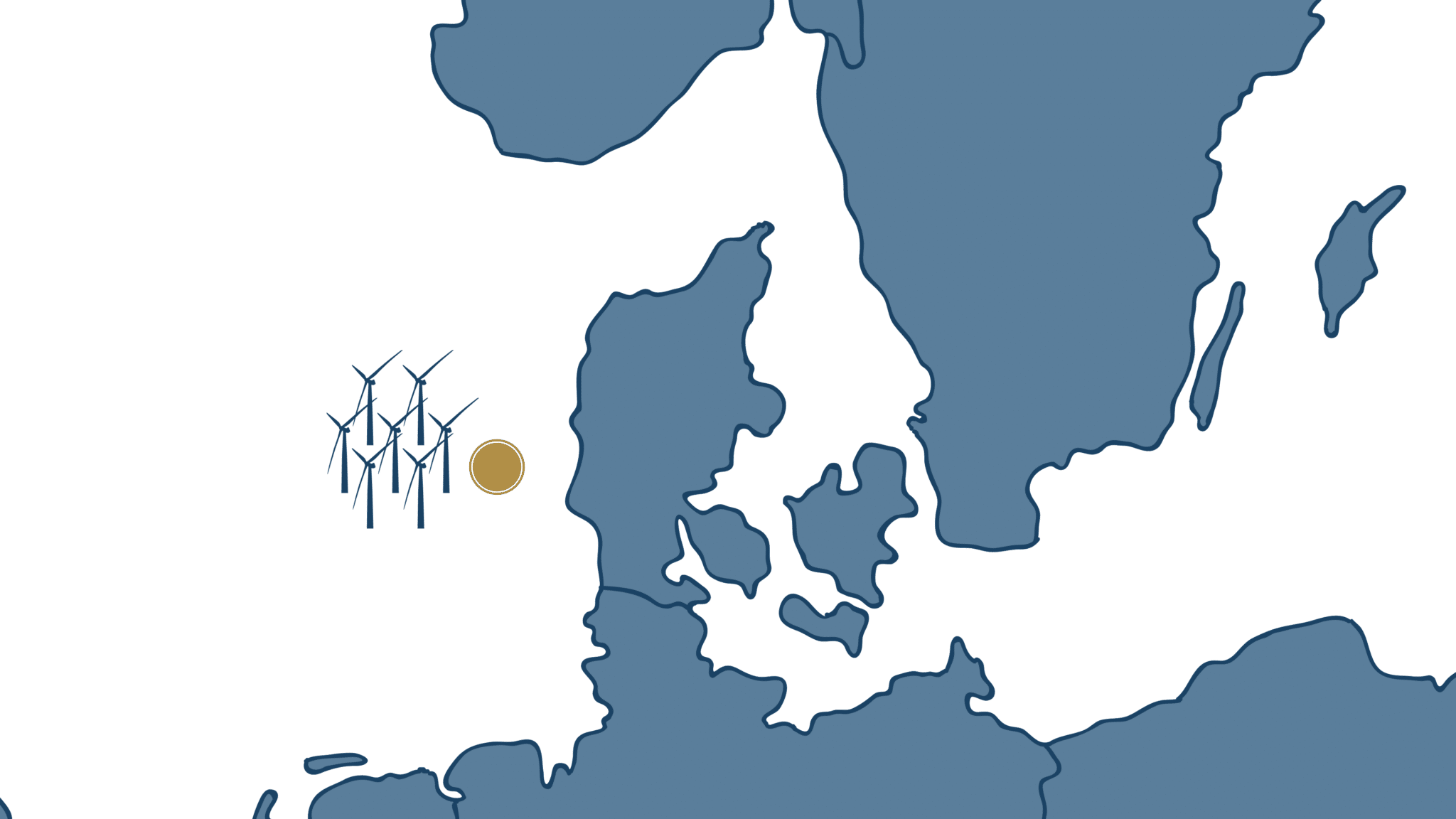

“We must utilize the large offshore wind potential in the North Sea, and the government is sticking to its ambition to realize an energy island in the North Sea. The project is important for both Denmark’s and Europe’s green transition as well as for security of supply. When we plan projects of this magnitude, we must of course also ensure that we choose the most responsible solutions. We are now taking a little longer for that, so that we can make a decision later in the year” (kefm.dk)

Despite the postponement of the project material, the rules on taxation are still in force from 2024. This is a reminder that the legislation encompasses more than the energy islands.

Read more about the introduced taxation for the energy islands, how to navigate compliance and taxation for the Danish energy islands, or the legislation regarding taxation of individuals.