Understanding the A1 Certificate

The A1 certificate is a document used within the EU/EEA and Switzerland to confirm which country’s social security system an employee is subject to when working in multiple countries. It helps prevent double social security contributions and ensures that the employee is covered by the social security system of one country at a time, typically their home country. Furthermore, the A1 is documentation as to which country an employee is covered by social security.

The social security coverage is sometimes relevant when also considering the Danish taxes of the employee. As examples, employees may be able to claim deductions for social security contribution in their Danish tax return or employees may not be granted tax relief in accordance with a double tax treaty (especially the treaty covering the Nordics).

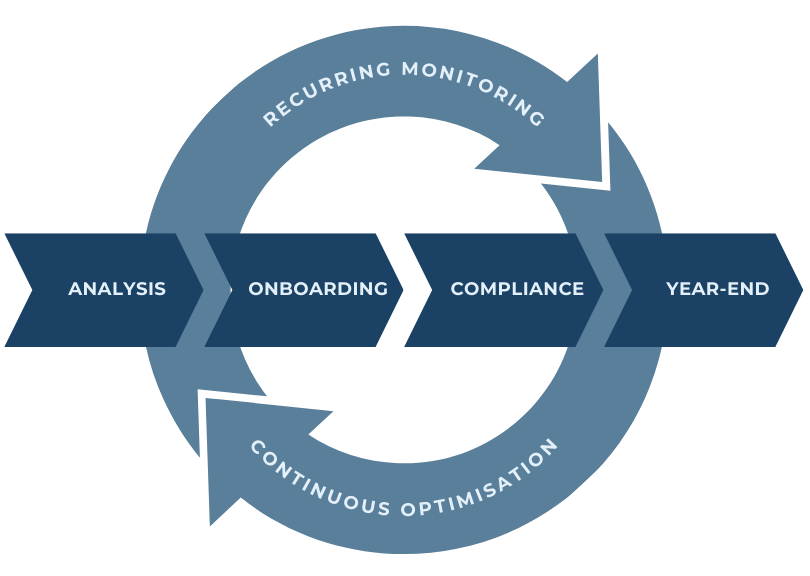

The Crossbord Solution

Crossbord offers a comprehensive solution to these challenges. The Crossbord Solution includes services that ensure compliance with international tax and social security regulations. By acting as a liaison between employers, employees, and tax authorities, Crossbord ensures that all necessary documentation, including A1 certificates, are correctly filed and maintained, as well as the position of the employee is monitored consecutively. This approach minimises the risk of non-compliance and simplifies the complex processes associated with cross-border employment.

The impact of the A1 certificate based on recent case law

According to the Danish Tax Agency’s guidelines on tax deductions for foreign social security contributions, an A1 certificate is necessary to prove that the social security contributions paid abroad are mandatory. Without this certificate, deductions for these contributions might not be granted, leading to higher taxable income and potential double taxation.

Case Study: SKM2022.282.LSR

The case SKM2022.282.LSR highlights the consequences of not having an A1 certificate. In this case, a Danish worker employed in Norway was initially denied tax deductions for Norwegian social security contributions by the Danish Tax Agency due to the lack of an A1 certificate. However, the Danish Tax Tribunal (Landsskatteretten) overturned this decision, recognizing other forms of documentation as sufficient proof.

Details of the Case:

- The employee presented documentation other than the A1 certificate to prove their social security contributions in Norway.

- The Tribunal found the provided documentation adequate to demonstrate that the contributions were mandatory under Norwegian law.

- This ruling indicates that while the A1 certificate is the standard document, other forms of proof can sometimes suffice if they meet the necessary criteria.

This case underscores the necessity of clear documentation to avoid disputes and ensure compliance.

Case Study: Journal Number 20-0084482

A more recent case, journal number 20-0084482, further illustrates the complexities of cross-border taxation and social security. In this case, a pilot employed by an Irish company but based in the UK faced challenges with tax and social security contributions in both Denmark and the UK.

Details of the Case:

- The pilot’s payroll records indicated deductions for social security contributions in the UK.

- Despite this, the Danish Tax Agency required an A1 certificate to validate the pilot’s social security contributions.

- Without this certificate, the deductions for these contributions were denied, even though the payroll records clearly showed the contributions.

This case highlights the strict requirements for documentation and the potential difficulties in obtaining tax relief without an A1 certificate.

Benefits of the A1 Certificate

The primary benefit of an A1 certificate is that it prevents employees from paying social security contributions in more than one country.

The certificate guarantees that employees are covered under their home country’s social security system, ensuring continuous benefits.

Having an A1 certificate simplifies the compliance process with tax authorities in different countries.

Proper documentation can lead to significant tax savings by allowing for deductions that would otherwise be denied.

In Conclusion

In a global work environment, ensuring compliance with international social security regulations is crucial for businesses and their employees. Obtaining an A1 certificate is a critical step in this process, as it helps prevent double contributions and ensures continuous social security coverage. The Crossbord Solution provides the expertise and support needed to navigate these complexities, ensuring that businesses can focus on their core activities without worrying about compliance issues.

By understanding and implementing the proper documentation, such as the A1 certificate, businesses can ensure smooth operations across borders and avoid unnecessary financial burdens.