Yet, companies often struggle to address the administrative and financial challenges their employees face when relocating to a new country. Tax complexities, social security obligations, and unfamiliar regulations can turn relocation into a source of stress, undermining employee satisfaction and retention. Crossbord provides tailored solutions—such as tax briefing, onboarding, and first-year tax support—that help companies eliminate these challenges, enabling employees to focus on their work and settle into their new environment. This makes it easier for businesses to retain international talent.

The many challenges of recruiting international employees

Recruiting international talent is no easy feat. Companies across industries face significant obstacles in attracting and retaining foreign workers. Cultural differences, language barriers, and unfamiliarity with local systems often create a difficult adjustment period for employees. These issues are compounded by the practical challenges of handling tax obligations, social security registration, and other administrative tasks.

Furthermore, the administrative burden of navigating foreign tax systems is a major reason why international employees choose to leave. Employees often feel overwhelmed by unclear processes or incorrect filings, which can result in financial penalties and increased stress. These factors directly impact their satisfaction and retention.

Companies cannot solve every challenge for international employees, but they can address one of the biggest stressors: tax compliance. This is where Crossbord’s tailored solutions make a tangible difference.

Crossbord eliminates tax complexity

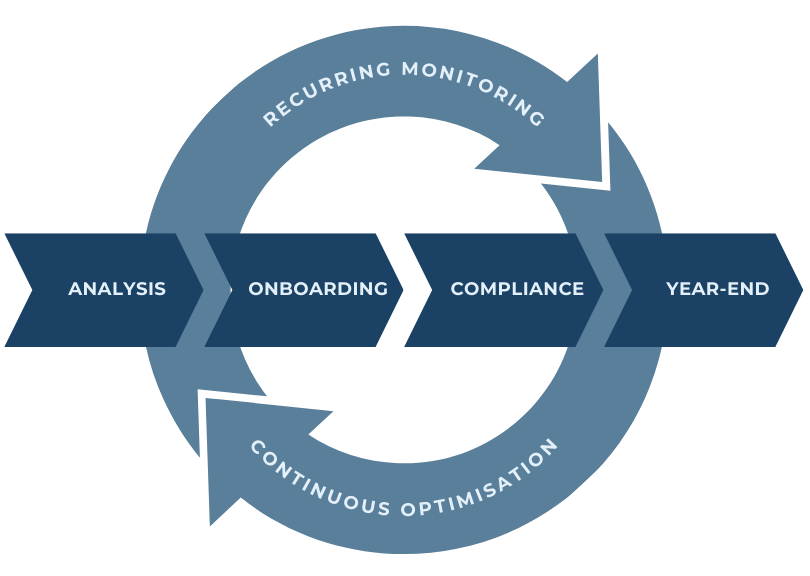

Crossbord specialises in removing tax complexity as a barrier for international employees. By simplifying the onboarding and tax filing process, Crossbord allows employees to focus on their work while feeling confident about their financial obligations.

For example, a global shipping company headquartered in Denmark faced recurring challenges with their international hires. Employees struggled with the complexities of Denmark’s tax system, especially when integrating foreign incomes and assets into their filings. Crossbord stepped in with a two-pronged approach:

- Proactive tax briefing and onboarding: Employees were guided through their preliminary tax assessments, ensuring all foreign incomes, relocation allowances, and other factors were accounted for. This eliminated confusion and gave employees a clear understanding of their financial obligations.

- Support for first-year tax filings: Crossbord provided hands-on assistance to ensure all foreign incomes, properties, and securities were reported accurately, avoiding errors that could lead to penalties or disputes.

By addressing tax complexity, Crossbord removed one of the biggest hurdles for international employees, enabling them to focus on their roles and integrate smoothly into their new environment.

A critical piece of the retention puzzle

Crossbord’s services do not solve every challenge international employees face; cultural integration, language barriers, and family concerns remain. However, by eliminating the stress of navigating complex tax systems, Crossbord creates a smoother transition for employees and a more supportive environment for employers.

This is particularly critical as companies compete to retain international talent. Research shows that employees are more likely to stay when they feel supported in practical matters like tax and compliance. By focusing on this area, Crossbord helps companies strengthen their employer branding and build trust with their workforce.

Employer branding and competitive advantage

Incorporating robust support for international employees is not just a practical measure; it is a strategic one. Companies that prioritise the administrative and financial well-being of their employees stand out as attractive employers. Crossbord’s integrated services enable companies to present themselves as proactive and reliable, fostering trust among employees.

Furthermore, research consistently shows that the cost of replacing skilled employees is high, often exceeding twice their annual salary. Retaining talent through better support systems is not only cost-effective but also strengthens company culture and productivity.

Retain international talent by turning challenges into opportunities

Recruiting international employees comes with many challenges, from cultural integration to navigating complex local systems. Crossbord cannot solve them all, but we can eliminate one of the most significant barriers: tax compliance. By simplifying and streamlining the tax process for international employees, Crossbord removes a major source of stress and creates a foundation for long-term retention.

For companies looking to thrive in a globalised job market, this focus on eliminating friction is not just an advantage; it is a necessity to retain international talent.

Read about The Crossbord® Solution.