Give your employee the best start in Denmark

How one settles, and how fast one feels at ease and at home somewhere, is strongly linked to how easy a start one gets.

When you hire new employees from abroad, they are liable to pay tax in Denmark from the first day of work. Depending on each employee’s personal and financial situation, they may be subject to different types of tax liability. Common for all is that they will need a personal tax number (CPR-number), a tax card (skattekort), a NemKonto, and a MitID.

Learn how to help your international, non-Danish employee get the best possible start in Denmark.

Get it right from the start

Several things make sense to have sorted out right from the start when arriving in and before starting work in Denmark, e.g., the CPR-number, a tax card, MitID, and a NemKonto.

As employer, you can help your employee by either helping them apply, or directly applying on their behalf. In the latter case, however, it is important to have a power of attorney, otherwise you will not be able to apply on behalf of your employee.

Book a meeting to go over how to best introduce your employee to Denmark and the Danish system, or book a tax briefing for your employee below.

Tax card and personal registration number

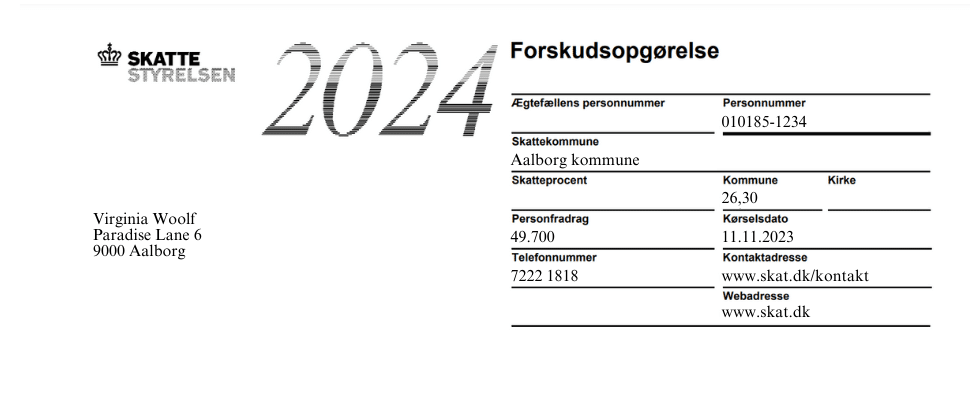

Your employee needs a digital tax card (skattekort) and a CPR-number (referred to interchangeably as a personal registration number, a tax number, or a civil registration number) in order to pay the correct amount of tax on their Danish salary. If your employee does not have a tax card, they will be charged 55% in tax of their salary.

The tax card is sent directly to the employer, who is responsible for withholding the correct amount of tax, paying it directly and reporting it to the Danish Tax Authority, and paying the rest of the salary directly to the employee of course.

Crossbord has extensive experience assisting companies and their employees attaining a CPR-number and skattekort. Book a meeting with one of our consultants about onboarding of new employees to Denmark. Select date and time below.

Facts about the tax card

A tax personal registration number (CPR-nummer) is only issued once.

If your employee leaves and comes back to Denmark, they can use the same number again.

If your employee doesn’t have a tax card, they will pay 55% of their salary in tax.

The earliest possible time to apply for a tax card is one month before job start.

There are three types of tax cards:

The main card can only be used by one employer. It states how much tax to pay, and also a deductible amount that does not need to be taxed (fradrag). Tax will only be payed on the amount that is higher than the deductible.

The free card states an amount you can earn without paying taxes.

The bi card states how much tax to pay. If a person has more than one employer, the main card will be used by the main employer, who pays the most salary. They will be responsible for withholding tax on the paid salary. The employers who use the bi card will not deduct anything from the paid out salary, and full tax will be withheld.

Get your employee set up with MitID

MitID is a digital ID, which can be used for various purposes, for example to transfer money when using online banking, or to log into public self-service solutions like skat.dk, borger.dk, and sundhed.dk. MitID is primarily an app in which you can approve your actions online with an easy swipe-function. There are alternatives available if you cannot or do not want to use the MitID app, such as the MitID code display, MitID code reader, and MitID chip. MitID is free to obtain and use, and it is not a requirement to have MitID.

There are a few steps to follow when ordering a MitId for your non-Danish employee.

- Book an appointment at a local Citizen Service Centre (Borgerservice)

- Go to the Citizen Service Centre with your employee.

Bring your own ID, your employee’s passport or ID from their country, and their Danish ID, if they have it. - Bring a witness to attest the procedure (and they should also bring valid ID and MitID)

Help your employee assign a NemKonto

All citizens and companies registered in Denmark are required to have a NemKonto (named by putting the Danish words for easy and account together).

A NemKonto is a normal bank account that you assign as your NemKonto, and all payments from the public sector such as tax or VAT refunds, child subsidies, pensions, student loans, unemployement benefits, housing support, etc. will receivede here.

Your employee can either get a NemKonto assigned through a Danish bank or through a non-Danish bank.

- Danish Bank:

- Your employee can do it themself by logging into their Danish bank and assign the account they wish to have as NemKonto. It is usually straight forward, but requires your employee to authorise the action with MitID.

- Your employee can contact their local bank and simply inform them, which account they wish to have as NemKonto.

- Non-Danish Bank:

- Go to NemKonto Selvbetjening and assign a foreign (to Denmark) bank account as NemKonto.

See our guide on how to assign a non-Danish bank account as a NemKonto.

- Go to NemKonto Selvbetjening and assign a foreign (to Denmark) bank account as NemKonto.

Get your employee's tax card

Register the employment information regarding your new employee and request the tax card (eSkattekort) at the same time.

Follw our guide on how to get a tax card from e-Income (eIndkomst) here.

Tax liability for your non-Danish employee

In accordance with Kildeskatteloven cf. 1, a person is fully tax liable to Denmark if this person has permanent residence in Denmark, or if this person resides in Denmark for a period of 6 months without a permanent residence, including short trips out of Denmark for holiday or similar activities.

Permanent residence in Denmark = Full tax liability

A person has limited tax liability in Denmark if they acquire income in the form of remuneration for personal work in a service relationship performed in Denmark according to Kildeskatteloven cf. 2, sub. 1, no. 1, or if they acquire income in the form of remuneration for personal work in connection with being made available to carry out work for a company in Denmark, when the work forms an integral part of the company, Kildeskatteloven cf. 2, sub. 1, no. 3.

Remuneration for work carried out in Denmark OR for work in connection with being made available to carry out work for a company in Denmark (where the work is an integral part of the company) = Limited tax liability

Get Tax Assistance

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord