How to:get a tax card from e-Income

In order to report salary and withheld taxes for your employees, you need to send in employment information to eIndkomst and order a tax card, referred to either as “Skattekort” or “eSkattekort” in Danish. Even if you don’t need to withhold tax when paying your employees salary, e.g., in the situation where your employee is covered by the Tax Scheme for Researchers. Both the registration of employment details and the request for a tax card can be done at the same time, and you will only need to do it once. If changes arise in the employment you can always edit the information, e.g., in the case of termination of the employment.

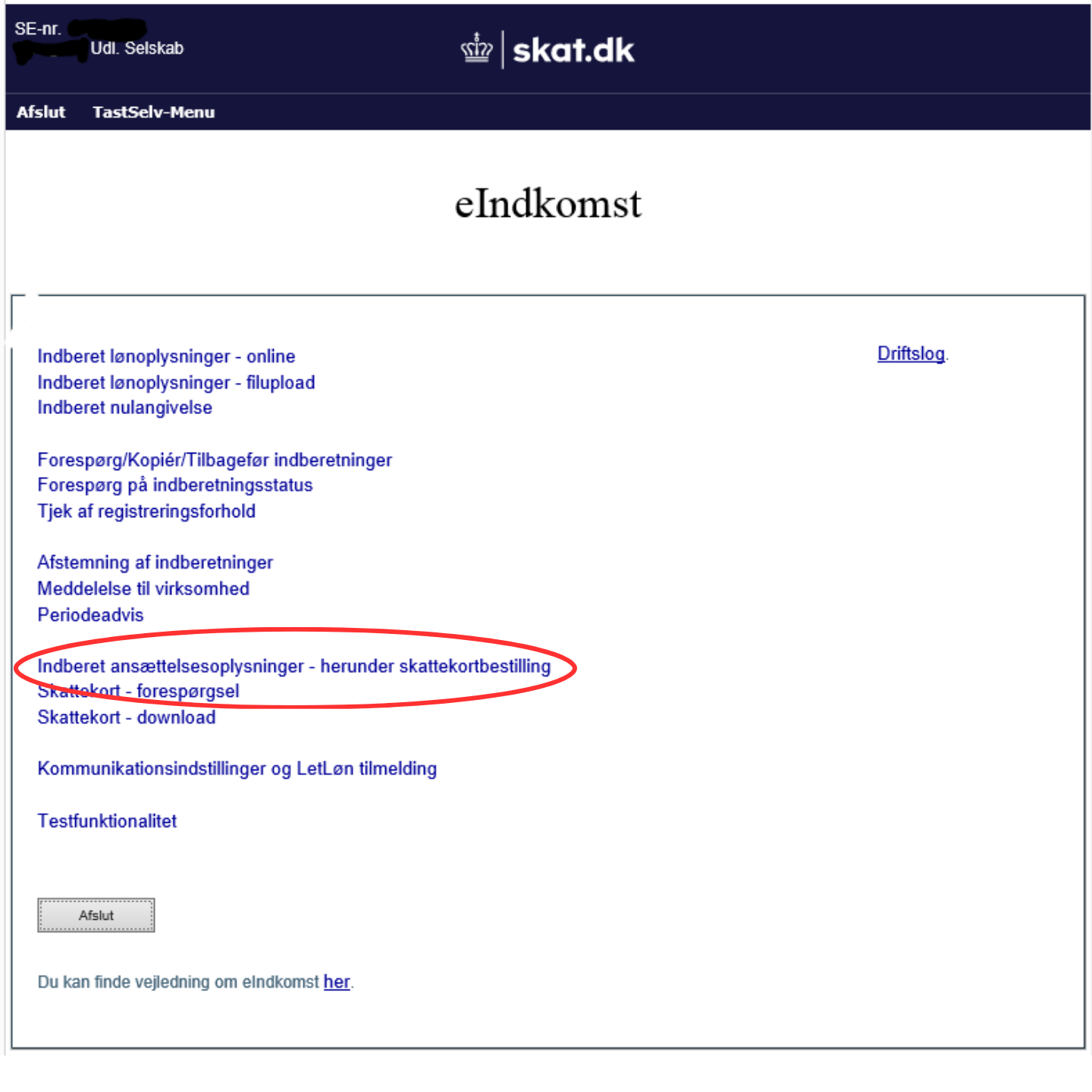

Step 1/5

First log into eIndkomst. You will find yourself in production environment of eIndkomst, and you will be able to see the main menu. Choose “Indberet ansættelsesoplysninger – herunder skattekortbestilling“.

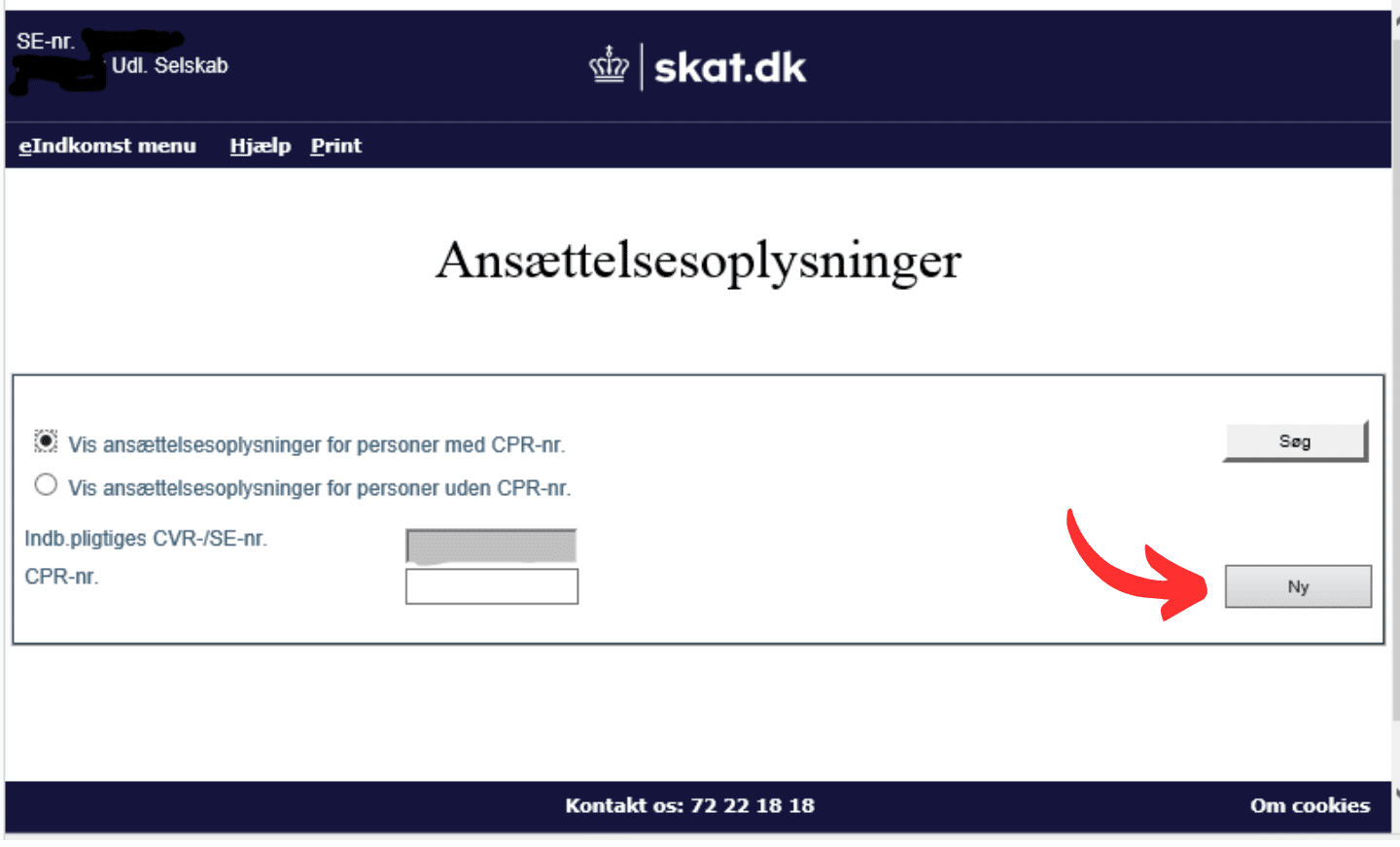

STEP 2/5

Here you should be able to see or create employment information. You can see already existing employees (searchable via CPR-number).

To create a new employee, click “Ny” (New).

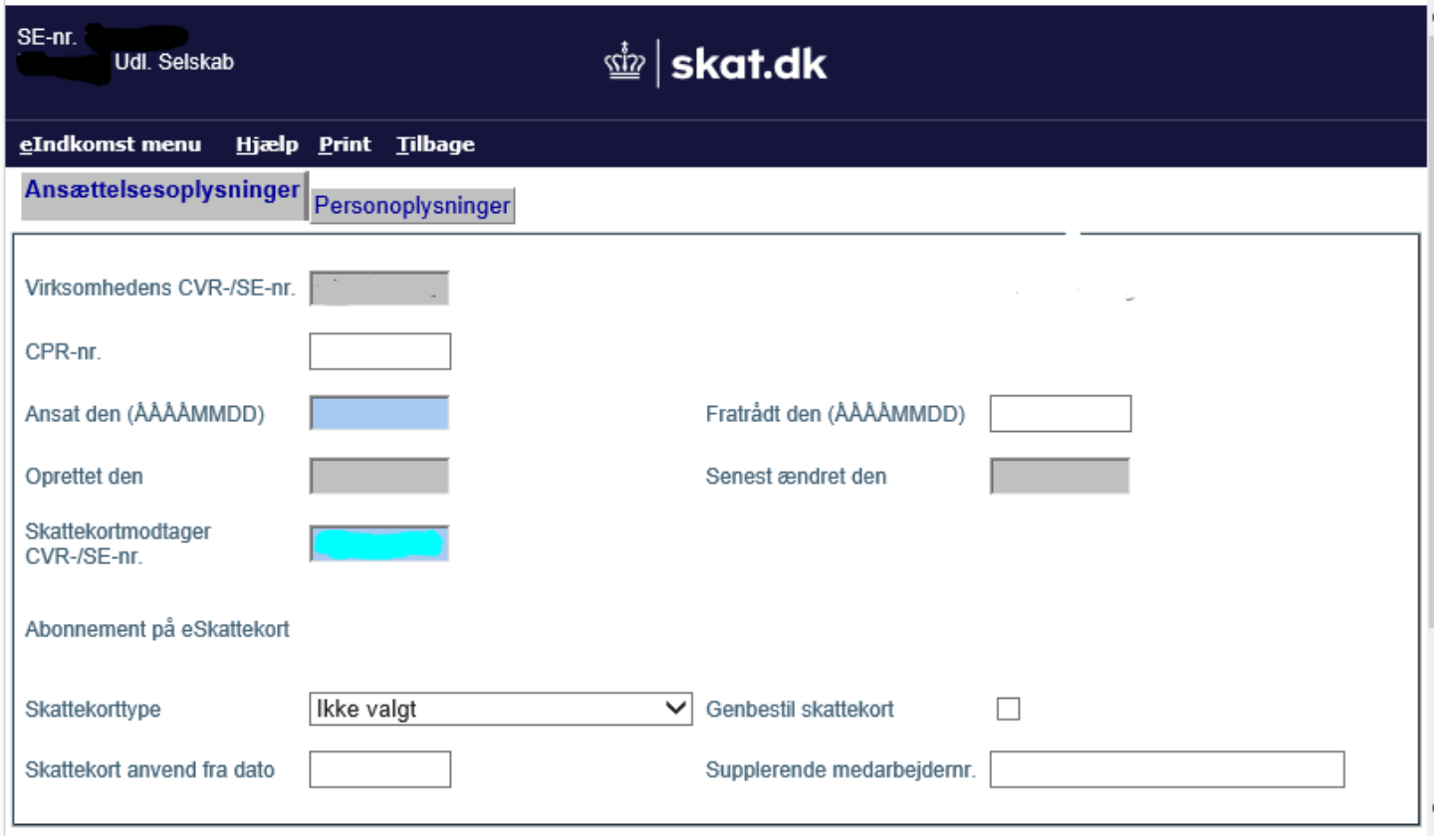

STEP 3/5

Fill in the fields under the tab “Ansættelsesoplysninger” (employment information):

- The fields with CPR-nummer (personal registration number), employment start date, and type of tax card must be filled.

- You can include an employment number if you wish, you will receive this number with the file with tax card information (eSkattekortoplysninger).

- You can fill out the last day of employment, if you know it at the time when you are creating the new employee in eIndkomst. If you fill in this field, the tax card you receive will only cover the employment period. If you do not fill this field, the last day of the employment must be entered when the employment is terminated.

- If your employee is not Danish and does not have a CPR-number, or if your employee is Danish but lives abroad, you will also need to fill out the tab with “Personoplysninger” (Person information).

STEP 4/5

You will receive an email, once the tax card is ready. The email will be sent to the email registered in “Kommunikationsindstillinger og LetLøn tilmelding”. If no email is registered here, the email will be sent to the email registered under “TastSelv Erhverv under Profil – Generelle kontaktoplysninger”. The email should arrive within 30 minutes to 2 hours after you have requested the tax card, however it might take longer in peak periods (at the end of the month).

You can find the tax card information via the main menu point “Skattekort – forespørgsel”.

To see your employee’s tax card, first choose “Vælg funktion” and select “Skattekort” in the drop down menu.

STEP 5/5

Now you should be able to see your employee’s tax card.

See a guide in Danish on info.skat.dk (we have borrowed the images from this guide).

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord