10 billion DKK yearly tax break

The Danish government has propsed a 10 billion Danish Kroner (DKK), roughly 1.3 billion EUR, tax break from 2026. The tax break will come into effect from 2026 and save Danish tax subjects an estimated 10 billion DKK yearly.

While 3.3 million Danes will receive tax breaks of said 10 billion DKK, roughly 8000 Danes will have to pay more in taxes due to the introduction of a new “top-top-tax” (top-top-skat) for persons with a yearly income of more than 2.5 million DKK.

Those who already pay top tax will be moved to a bracket of in-between tax (mellem-skat) of 7,5% instead of the current 15%. Persons who do not pay top tax will receive a yearly tax break of roughly 3000 DKK.

Before 2026

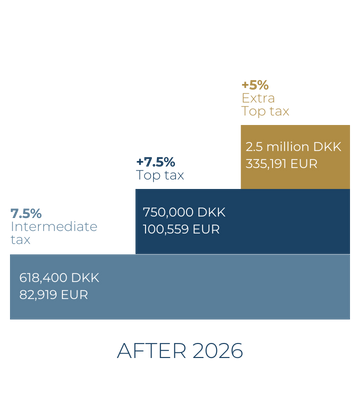

After 2026

15% top tax

618,400 DKK | 82,919 EUR

+5% extra top tax

2.5 million DKK | 335,191 EUR

+7.5% top tax

750,000 DKK | 100,559 EUR

7.5% Intermediate tax

618,400 DKK | 82,919 EUR

Link to source: The Danish Ministry of Economic Affairs (text in Danish)

Link to source: The Danish Ministry of Economic Affairs (text in Danish)