The Case of W.M.: A Complex Cross-Border Employment Situation

The C-329/23 ruling concerned W.M., an Austrian national who was self-employed in Austria, Liechtenstein, and Switzerland. Prior to the case, W.M. had been covered under Austrian social security law according to Regulation No. 1408/71, which applied to individuals working across borders within the European Economic Area (EEA) before being replaced in 2010 by Regulation No. 883/2004. However, with the introduction of the new regulation, a reassessment of W.M.’s social security obligations was required.

W.M. faced a unique situation as his professional activities were spread unevenly across three countries: 19% of his income derived from Austria, 78% from Liechtenstein, and 3% from Switzerland. This uneven distribution led to the question of which country’s social security legislation should apply to him. Under EU regulations, an individual can only be subject to the social security system of one country at a time, but determining which country that should be when work is spread across multiple jurisdictions is often a legal grey area.

The EU Court of Justice’s decision focused on the application of Regulation No. 883/2004, which governs social security coordination across the EU. The court clarified that multi-state workers are subject to the legislation of the country where they either reside or conduct a substantial part of their activities. In W.M.’s case, the substantial part of his activities occurred in Liechtenstein, but since Austria was his country of residence, it remained an open question which social security system should apply.

Legal Implications of the Ruling

This ruling highlights the broader implications for businesses employing workers across multiple countries. Under Regulation No. 883/2004, the general rule is that a worker is subject to the social security system of their country of residence, provided that a substantial part of their activities takes place there. If the individual does not conduct a significant portion of their work in their country of residence, the country where the centre of interest of their activities lies takes precedence. The centre of interest is determined by factors such as the individual’s income, the number of services provided, and their working hours.

For companies managing such cases, the decision underscores the importance of ensuring that workers are correctly classified under the right social security system. Misclassifying an employee’s social security obligations can result in significant penalties and compliance risks, including the need for back-payments of social security contributions and potential legal disputes. The ruling also demonstrates the importance of staying informed about which regulations apply when non-EU countries like Switzerland are involved. Switzerland, while not an EU member, participates in certain agreements with the EU that add another layer of complexity to such cases.

Impact on International Payroll Compliance

For businesses, the complexities of cross-border social security coordination go beyond legal compliance. They directly affect payroll systems, reporting, and employee benefits administration. The risk of getting it wrong is high: non-compliance can result in fines, delays in social security benefits, strained relations with the authorities, and concerns with proper compensation to the employee.

Payroll systems must be agile enough to adapt to the diverse social security requirements of each country where employees operate. In a case like W.M.’s, an organisation would need to assess each country’s laws, understand the implications of the EU ruling, and ensure that contributions are correctly reported. For companies that manage multi-state workers, this can be an administrative burden, especially if they lack in-house expertise in international payroll management.

The Crossbord Solution: Simplifying Multi-State Payroll and Social Security Compliance

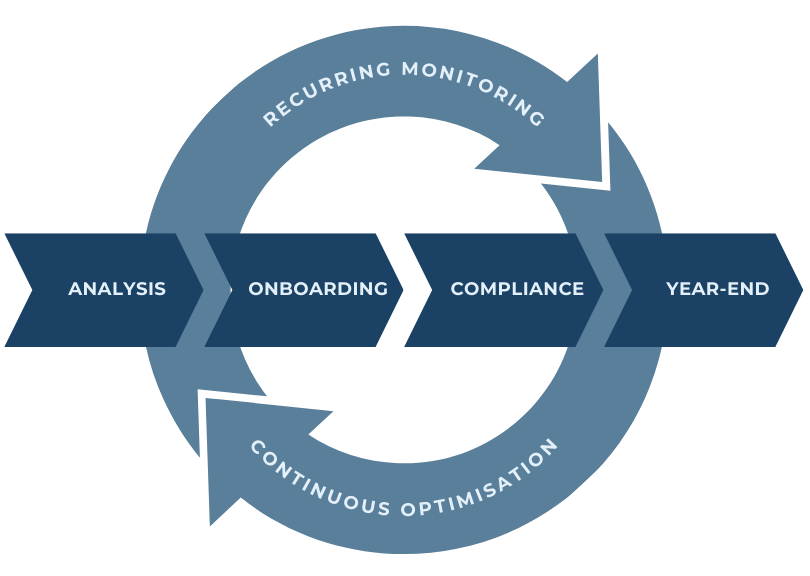

Given the complexities highlighted by the C-329/23 ruling, businesses need a solution that not only ensures compliance with multi-state social security regulations but also reduces the administrative workload. This is where The Crossbord Solution comes into play. Crossbord offers a comprehensive payroll and compliance service designed to help companies navigate the challenges of cross-border employment.

The Crossbord Solution ensures that businesses remain compliant with the social security regulations of all relevant jurisdictions. Whether dealing with EU member states or countries with special agreements like Switzerland, Crossbord’s team of experts manages the intricacies of social security coordination, payroll reporting, and tax compliance on behalf of the employer. This eliminates the need for individual tax returns for employees, as all compliance requirements are addressed directly through the employer’s reporting obligations.

What sets Crossbord apart from other advisory firms is its proactive approach to handling the relationship between employers, employees, and tax authorities. By ensuring that the correct social security system is applied, Crossbord reduces the risk of penalties and administrative delays, helping companies to avoid the costly mistakes that often arise when dealing with multi-state workers.

Why Choose The Crossbord Solution for Multi-State Payroll Compliance?

Crossbord manages the complex task of determining which country’s social security laws apply to multi-state workers, ensuring that all contributions are made correctly and on time.

Crossbord handles payroll setup and administration for employees working in multiple countries, reducing the burden on businesses and ensuring that payroll processes align with local regulations.

Crossbord’s team is highly experienced in managing compliance issues for countries outside the EU, including those like Switzerland that participate in special agreements with the EU.

With Crossbord’s services, businesses can avoid the need for individual tax returns for their employees, as all necessary reporting is completed by the employer in compliance with local regulations.

Staying Ahead in a Complex Regulatory Landscape

The C-329/23 ruling serves as a crucial reminder for businesses that employ workers across borders: staying compliant with social security regulations requires a thorough understanding of both EU laws and the specific agreements that may apply in non-EU jurisdictions. Companies must be proactive in managing their payroll and social security obligations to avoid penalties and ensure that their employees receive the benefits they are entitled to.

By leveraging The Crossbord Solution for cross-border payroll and social security compliance, businesses can stay ahead of these challenges, ensuring compliance while reducing the administrative burden on their teams. Crossbord’s expertise in navigating the complexities of multi-state social security systems makes it an indispensable partner for companies operating in an increasingly globalised workforce.