The responsibillity of the Employer

In the end, the responsibility of ensuring that everything is done correctly rests on the employer.

Have you withheld too much or too little A-tax or labour market contributions during 2023, and have you, therefore, reported the salary that your employee has been paid incorrectly, you as the employer are responsible for ensuring that the discrepant gross amount is corrected. You are also responsible for reporting the correction to the Danish Tax Authorities. This must all be handled within the deadline of the 15th of February 2024.

Read more about tax reporting and the responsibilities of the employer here.

Payroll is the hero

95% of a tax return is solved through correct payroll.

Most of our corporate clients (employers) already have all the information needed upholding their duty of withholding and reporting their employees’ taxes to the Danish Tax Authorities.

Nobody likes surprises when it comes to taxes. To ensure that your employee finds themself in a comfortable situation with total trust in you to withhold and report their taxes correctly you need a sturdy administration, especially if your employees have special, non-standard circumstances.

Your payroll administration shoulders a big responsibility to correctly withhold and report taxes so that reality lives up to the expextations.

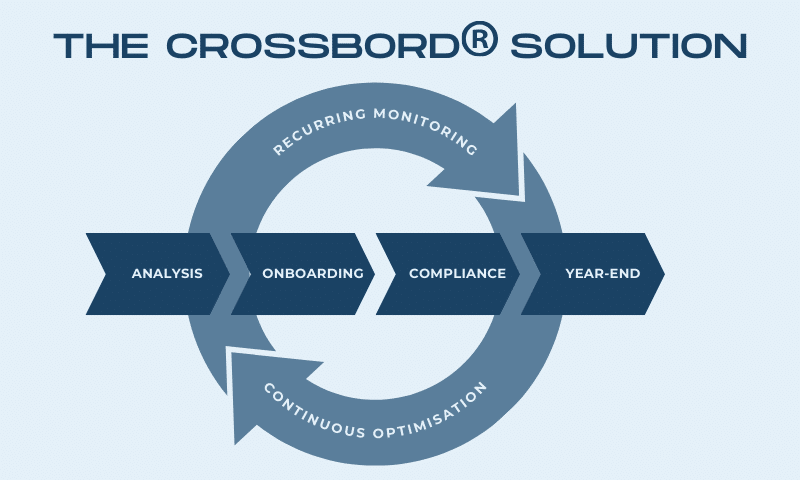

The Crossbord ® Solution

With The Crossbord® Solution, we offer a continuous focus on your case to ensure that compliance is up to date with your situation. With our integrated service, reality is constantly verified in accordance with the prior analysis. This way, we can flag potential changes that impact both employer and employee, making it possible to adjust the process, the situation, or the expectations to the particular case or situation.

Reasons to use Crossbord

We are recognised as a trusted advisor by global corporations and well-known brands. The basis of our delivery is rooted is expert knowledge on international tax and social security along with the ability to run compliance and payroll to facilitate the solutions found.

We are devoted to ensure compliant behaviour and consider the modern client someone, who prioritises compliance, not only in the context of running a legal operation but also because they appreciate the reputative benefits of doing so.

Your actions will directly impact your employees and you probably want to avoid generating unnecessary friction or frustration that requires special care and attention to address and solve. Your employees are the main focus point in our integrated service, but all the benefits are available for you, the employer, to reap.

Get Tax Reconciliation ASSISTANCE

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord