From the 1st of January 2026, the Danish Expat Tax Regime will become even more accessible, with the minimum salary threshold dropping to DKK 60,100. This change opens up the scheme to a broader pool of talent and gives businesses a valuable tool for global recruitment.

If your business is looking to hire internationally or already manages global talent, this scheme could unlock significant tax savings and recruitment advantages.

What is the Danish Expat Tax Regime?

Denmark’s inbound expat tax regime offers foreign researchers and key employees a significantly lower tax rate than the standard progressive tax system. The goal is to make Denmark more attractive to international talent by reducing the tax burden on highly skilled workers.

Under the scheme, qualifying employees pay a flat tax rate of 32.84% for up to 84 months (7 years). This rate consists of:

- 27% special tax rate

- 8% labour market contribution (AM-bidrag)

By comparison, the standard Danish tax system imposes progressive taxes, including top tax and top-top tax, which can push total taxation beyond 56% for high earners.

Who Qualifies for the danish Expat Tax Regime?

To qualify for the inbound expat tax regime, employees must meet the following criteria:

- Minimum salary: From January 1st, 2026, the minimum salary is DKK 60,100 per month (2024: DKK 75,100).

- Role: The employee must be a researcher or a key employee with essential skills.

- No tax liability in Denmark for the past 10 years: The employee must not have been subject to full or limited tax liability (fuld eller begrænset skattepligt) in Denmark during the previous 10 years.

- Direct employment: The employee must be employed by a Danish company or a foreign company with a permanent establishment (fast driftssted) in Denmark.

- 30-day rule: Employees fully tax liable and considered Danish tax residents under a double taxation agreement (DBO) cannot spend more than 30 workdays abroad per year if the right to tax their income shifts to another country.

Simplified Tax Comparison – 2026 Tax Rates

Below is a simplified example comparing net income under the expat tax regime and standard Danish taxation for a high-income earner in 2026.

Monthly income of DKK 60,100 (new 2026 threshold)

- Inbound expat tax regime (32.84%): Net monthly income: DKK 40,369

- Standard tax regime: Net monthly income: DKK 35,451

- Difference: Employees under the expat tax regime receive 14% higher net income.

Monthly income of DKK 250,000

- Inbound expat tax regime (32.84%): Net monthly income: DKK 167,900

- Standard tax regime (including top tax and top-top tax): Net monthly income: DKK 98,474

- Difference: The expat tax regime provides a 27.8% higher net income for high earners.

Note: These calculations are based on the 2026 tax rates and reflect the introduction of the top-top tax of 20% on annual incomes exceeding DKK 2.5 million.

Why Should Businesses Care?

For many companies, the ability to offer competitive net salaries is a game-changer when recruiting internationally. High taxation has long been cited as a barrier to attracting talent to Denmark, and the inbound expat tax regime helps level the playing field.

Benefits for businesses:

- More attractive offers – Increase the take-home pay of international hires without inflating gross salaries.

- Cost efficiency – Save on payroll taxes while attracting highly skilled professionals.

- Longer retention – The 7-year duration of the scheme provides stability and reduces turnover among critical hires.

How Crossbord Simplifies the Process

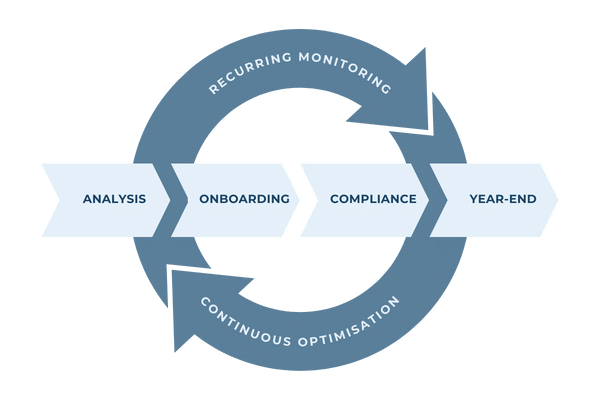

Navigating Denmark’s tax laws can be complex, and small errors can lead to disqualification from the scheme. At Crossbord, we specialise in managing every aspect of the Danish expat tax regime – from initial qualification checks to payroll setup and compliance monitoring.

Our services include:

- Eligibility assessments to ensure candidates meet all criteria.

- Payroll integration and setup for compliance.

- Ongoing advisory to help businesses optimise their recruitment strategies.

Read about The Crossbord Solution.

Strategic Recommendations for Businesses

- Identify qualifying roles: Focus on roles that require international expertise or where local talent is scarce.

- Promote the scheme in recruitment: Highlight the tax benefits to international candidates during recruitment.

- Review existing contracts: Restructure salaries to meet the DKK 60,100 threshold where possible.

- Engage with tax specialists: Ensure compliance and maximise benefits with expert tax advisory services.

Unlock the potential of international talent with Crossbord.

Whether you’re already hiring internationally or considering expanding your global workforce, we can guide you through the complexities of Denmark’s inbound expat tax regime.

👉 Book a free consultation today to discover how your company can benefit from the new 2026 changes.

FAQ – danish Expat Tax Regime (2026 Changes)

Who can apply for the scheme? Researchers and key employees with a minimum monthly salary of DKK 60,100 from 1 January 2026.

Can foreign companies apply the scheme? Yes, if they have a permanent establishment (fast driftssted) in Denmark and payroll is processed through a Danish system.

What disqualifies an employee from the scheme? Any full or limited tax liability in Denmark during the past 10 years generally disqualifies an applicant.

How long can the scheme be applied? The scheme can be applied for up to 84 months (7 years).

What is the 30-day rule? Employees cannot spend more than 30 workdays abroad if this results in another country gaining tax rights over their income while fully tax liable in Denmark.