A major update to the Øresund Agreement between Denmark and Sweden marks a significant step in modernising the taxation system for cross-border workers, with the introduction of clearer, streamlined rules that reduce administrative complexities. The proposal, presented on 2 October 2024, updates the original 2003 agreement to reflect the evolving nature of cross-border work, particularly as more people are working remotely and seeking flexibility in how and where they perform their jobs. See the previous revision or our theme page on the Øresund Agreement.

For the estimated 18,000 people who commute daily between Denmark and Sweden, this agreement aims to eliminate many of the tax-related challenges they have previously encountered. The Danish and Swedish governments expect these revisions to facilitate greater cooperation in the Øresund region, making it easier for businesses to recruit and retain talent while ensuring that cross-border workers are taxed fairly.

Key Updates in the Agreement: A Breakdown of the Provisions

1. Income Taxation for Cross-Border Workers (Article 1)

One of the major changes in the revised Øresund Agreement is the introduction of clearer rules regarding the taxation of income for workers who live in one country but work in the other. According to Article 1 of the agreement, a cross-border worker will primarily be taxed in the country where their employer is based, regardless of whether the work is carried out in that country or remotely from their home country.

This is a significant change from the previous agreement, where only private-sector workers benefited from tax exemptions when working from home. Under the new rules, public-sector employees are now included, meaning public servants working for Danish or Swedish government institutions can also work from home without facing double taxation.

For the worker to remain taxed in the employer’s country, at least 50% of their total work must still be performed in that country over a 12-month period, an extension from the previous 3-month calculation period. This change offers greater flexibility for cross-border workers, particularly those seeking more home-based or remote work.

Additionally, the revised agreement removes the requirement that work be performed in the worker’s own home to qualify for the tax exemption. Now, workers can perform their duties from any location within their home country, such as a co-working space or a café, and still maintain the same tax treatment.

2. Public and Private Sector Equality in Taxation (Article 1)

The inclusion of public-sector employees in the same tax regime as private-sector employees is a major step forward. Previously, public employees who worked remotely in their country of residence were subject to the tax laws of their home country, often leading to double taxation issues.

With the new agreement, both public and private sector workers who split their time between the two countries can now enjoy equal tax treatment, eliminating the previous advantage for private-sector workers. This also simplifies tax reporting for public institutions employing cross-border staff.

3. Pension Taxation (Article 2)

Pension contributions have long been a point of complexity for cross-border workers. Under the revised agreement, Article 2 ensures that contributions made to a pension scheme in one country are deductible in the other. This means that a Danish worker contributing to a Swedish pension scheme can deduct those contributions from their taxable income in Denmark, and vice versa.

Importantly, this article ensures that pensioners receiving payments from schemes in one country will remain taxable on those payments in their home country, preventing double taxation on pension income. This change simplifies long-term financial planning for workers who spend significant portions of their career commuting between Denmark and Sweden.

4. Taxation of Educational Grants, Scholarships, and Artist Support (Article 4)

The new agreement also harmonises the tax treatment of educational support, scholarships, and artist grants. Previously, discrepancies in how these were taxed across the two countries led to unintended tax advantages or penalties, depending on where the recipient resided.

Under Article 4, support provided by either government will be taxed only in the country providing the grant or support, provided it would have been tax-exempt if the recipient had lived in the country of origin. This ensures that recipients of Swedish educational grants who live in Denmark, for example, are not taxed on this income in Denmark if it would not have been taxed in Sweden.

5. Proven Revenue Sharing Between Denmark and Sweden (Article 7)

To address concerns over revenue loss in the home country of cross-border workers, Article 7 introduces a revenue-sharing mechanism. Denmark and Sweden will exchange a portion of the tax revenue collected from cross-border workers to ensure that both countries benefit from income tax contributions. This exchange will apply to both public and private sector employees and will be calculated based on a new threshold of DKK 210,000, which will be adjusted annually for inflation.

This revenue-sharing mechanism recognises that both countries provide public services to cross-border workers and ensures that local municipalities on both sides of the Øresund benefit from the economic activity generated by these workers.

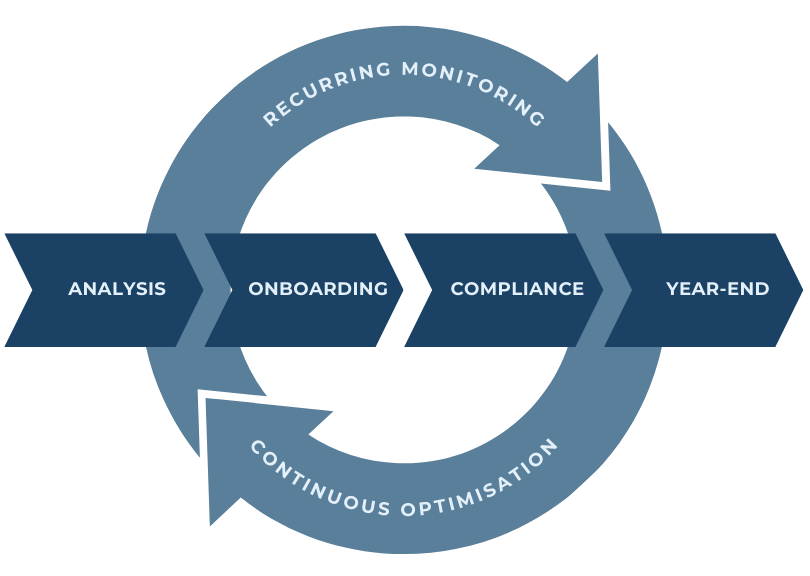

How The Crossbord® Solution Can Help Businesses your Cross-Border Employees

With the new Øresund Agreement in place, managing cross-border employees can become significantly less complex. However, handling tax compliance, payroll, and employee benefits across multiple jurisdictions can still be challenging. This is where The Crossbord® Solution can support you.

The Crossbord® Solution offers comprehensive payroll and compliance services tailored for companies with employees who live and work across national borders. For Danish and Swedish businesses, Crossbord ensures that all payroll functions, tax withholdings, and benefit contributions are accurately processed in accordance with the new Øresund Agreement. Additionally, Crossbord acts as a bridge between you, your employees, and tax authorities, facilitating the necessary complex reporting so that you can avoid the submission of individual tax returns for each cross-border employee.

By partnering with Crossbord, you can streamline your administrative processes, reduce the risk of non-compliance, and focus more on your core operations while ensuring that your cross-border employees are properly compensated and taxed. This service is particularly beneficial if you have a large number of employees regularly commuting between Denmark and Sweden or engaging in remote work.