The Crossbord® social security support service

Companies are increasingly deploying employees across international borders. Navigating the complexities of social security compliance can be challenging. Crossbord specialises in simplifying this process with our comprehensive A1 certificate service, ensuring your business remains compliant while allowing your employees to focus on their assignments.

As companies expand globally, managing social security compliance becomes increasingly complex. At Crossbord, we simplify this process with our comprehensive A1 certificate service. We ensure your business stays compliant, so your employees can focus on their assignments without worry.

Understanding the A1 certificate

The A1 certificate is an essential document for employees working temporarily in another EU/EEA country or Switzerland. It confirms that an individual continues to pay social security contributions in their home country or if they shall pay social security contributions in another country instead of their home country, thus avoiding dual contributions and ensuring compliance with European social security regulations.

Furthermore, the A1 certificate plays a significant role in taxation in Denmark. (Read more about A1 certificate’s crucial role in EU social security.) This documentation facilitates claiming tax deductions for contributions made abroad, optimising the employee’s tax situation and ensuring compliance with both home and host country tax laws.

When is the A1 certificate necessary?

Employees posted to work in another EU/EEA country or Switzerland need an A1 certificate to prove they remain under their home country’s social security system.

Even short-term business trips necessitate an A1 certificate to ensure that employees are covered by their home country’s social security.

Employees working in two or more countries must hold an A1 certificate to consolidate their social security contributions under one jurisdiction.

The A1 certificate prevents double social security contributions and allows employees to claim tax deductions for social security contributions made abroad.

Employees working in two or more countries must hold an A1 certificate to consolidate their social security contributions under one jurisdiction.

International assignments outside the EU/EEA

For work outside the EU/EEA, social security requirements can vary significantly depending on the country:

Denmark has social security agreements with several countries, including the USA, Canada, the Philippines and India. These agreements often cover pension rights and may require specific documentation to maintain Danish social security coverage (a so-called Certificate of coverage).

In countries without a social security agreement with Denmark, employees may be subject to local social security systems, requiring contributions in both the home and host countries unless exemptions apply.

Failure to obtain the necessary documentation can result in significant fines, administrative complications, and potential legal issues in the host country.

Processing times for social security applications

| Situation | Expected Processing Time |

|---|---|

| Work within the EU/EEA | 2-4 weeks |

| Work outside the EU/EEA with a bilateral agreement | 4-6 weeks |

| Work outside the EU/EEA without a bilateral agreement | 4-8 weeks (varies based on local rules) |

| Applications for multiple countries simultaneously | 6-12 weeks (due to complexity) |

Note: Processing times can vary based on the specific requirements of the host country and the completeness of the documentation submitted.

Case Scenarios

Case 1: Danish company temporarily posting an employee abroad for one year

In this scenario, a Danish company needs to second an employee to work in another EU country for a period of one year. The company must ensure compliance with all relevant social security and taxation regulations.

Determine whether the employee qualifies as being posted under EU regulations. This involves evaluating the temporary nature of the assignment and ensuring the employee remains under Danish social security coverage.

Draft an addendum to the employee’s contract to specify the terms of the temporary assignment, including duration, duties, and conditions related to the posting.

Submit an application for an A1 certificate to confirm that the employee remains under Danish social security during the posting period.

Verify that there are no requirements for social security contributions in the host country, leveraging the A1 certificate to avoid dual contributions.

Continue processing the employee’s payroll in Denmark, ensuring all social security and tax obligations are met domestically.

Case 2: Danish company with employees working across multiple countries

A Danish company has employees who split their time between Denmark and several other EU countries. One typical scenario includes employees working 50% in Denmark and 5-10% in other EU countries.

Evaluate whether employees are engaged in multi-country work and determine if Denmark remains the primary country for social security coverage under EU regulations.

Submit an annual application for the A1 certificate to cover the employee’s work in multiple countries, confirming Danish social security coverage.

Confirm that no social security contributions are required in the countries where the employee spends limited time, relying on the A1 certificate to avoid unnecessary contributions.

Handle payroll processing in Denmark, ensuring compliance with Danish social security and tax regulations.

Regularly verify the employee’s actual working locations to ensure compliance with the conditions set out in the A1 certificate and adjust the strategy if necessary.

Case 3: Danish company employing an employee to work 100% in another EU country

A Danish company employs an individual to work full-time in another EU country, not as a posted worker, but rather as a permanent assignment.

Evaluate the employee’s social security status to determine if they should be covered under the social security system of the host country rather than Denmark.

Adjust the company’s payroll processes to account for the social security obligations in the employee’s country of work, ensuring accurate deductions and contributions.

Ensure that all payroll and social security settlements are conducted in the host country, complying with local regulations.

Verify that no social security contributions are required in Denmark for the employee, given their full-time work status in another EU country.

Provide support to the employee to secure appropriate tax deductions on their Danish annual tax statement, ensuring all entitlements are claimed based on their non-resident status.

Our service

At Crossbord, we offer a comprehensive solution to manage the complexities of obtaining and maintaining A1 certificates and/or Certificate of Coverage, and other international social security documentation for your employees as well as the ongoing compliance of said contributions in the payroll.

The Crossbord Solution

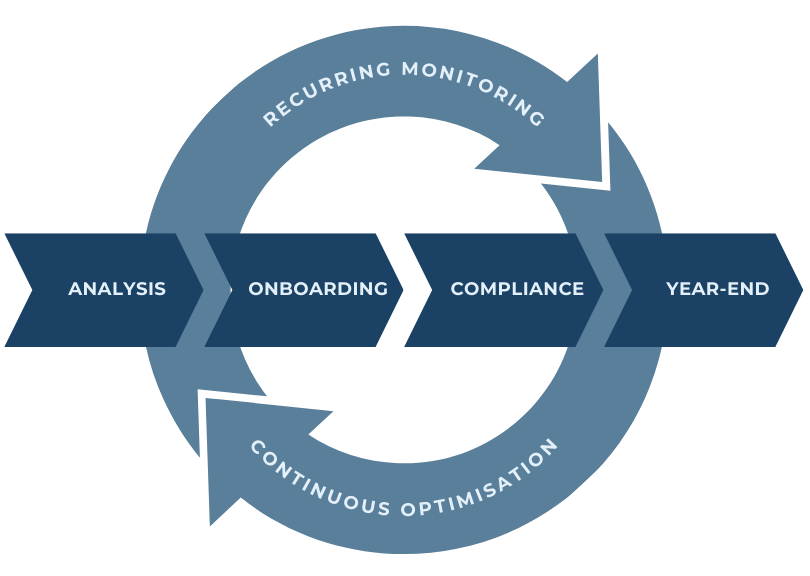

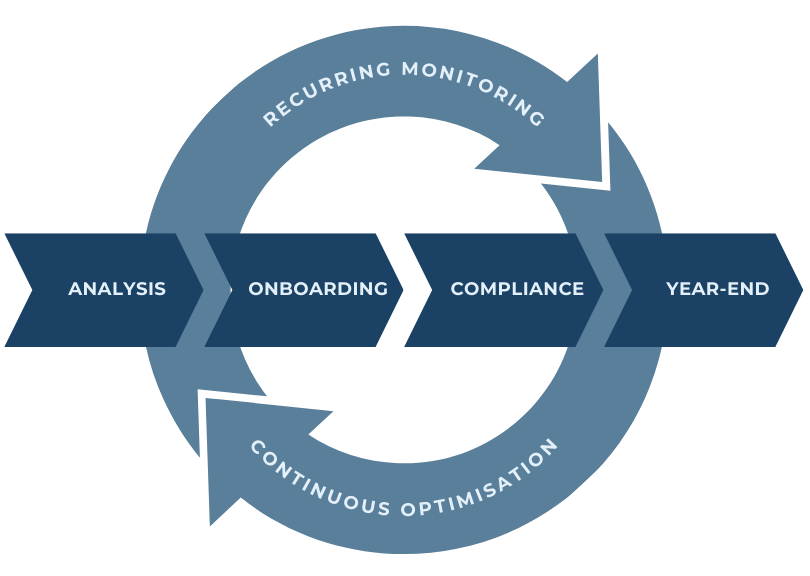

The Crossbord Solution is an all-encompassing service designed to tackle the complexities of cross-border tax, payroll, human resources, and advisory services. Our unique approach provides an integrated solution for businesses dispatching or receiving employees to or from Denmark, managing intricate and time-consuming compliance tasks.

The Crossbord Solution

The Crossbord Solution is an all-encompassing service designed to tackle the complexities of cross-border tax, payroll, human resources, and advisory services. Our unique approach provides an integrated solution for businesses dispatching or receiving employees to or from Denmark, managing intricate and time-consuming compliance tasks.

Personalised needs assessment

We begin with a detailed analysis of your tax positions, compliance requirements, and data needs for each employee. This ensures a tailored strategy that aligns with your specific business objectives.

Full-service application management

Our team conducts thorough onboarding and real-time processing of the necessary information, including payroll and monthly reviews. This process allows for timely adjustments and alerts to prevent compliance issues.

Expert compliance guidance

Our experts offer strategic advice on navigating both EU and non-EU social security regulations, ensuring you understand obligations and optimise compliance strategies.

Ongoing support and renewal services

We provide continuous support, managing renewals or extensions of existing certificates and agreements to ensure uninterrupted compliance.

The Crossbord Solution Advantage

Our services integrate effortlessly with your HR and compliance operations, reducing the administrative burden on your team.

Beyond A1 certificates, we assist with broader international tax and social security compliance, providing holistic support for your business needs.

We monitor regulatory changes and keep you informed, ensuring your business remains compliant in a dynamic international landscape.

social security support service

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord