The Crossbord® Solution

The Crossbord® Solution is a sophisticated, comprehensive service designed to to help businesses and employees navigate the intricacies of cross-border tax compliance, payroll, and human resources management. Our distinctive approach addresses cross-border taxation and compliance challenges with precision and specialised expertise.

Seamless Cross-Border Compliance for Danish and International Employee Mobility

Specifically tailored for organisations dispatching or receiving employees to or from Denmark, the Crossbord® Solution manages the complex and often time-consuming tasks essential to ensuring full compliance, mitigating potential penalties, and fostering peace of mind for both employers and employees alike.

By seamlessly integrating services across taxation, payroll, and regulatory compliance, our solution guarantees efficient handling of legal and operational requirements across multiple jurisdictions. Each phase is carefully customised to address the specific needs of internationally operating businesses, creating a harmonious experience throughout cross-border operations.

Organisations functioning across international boundaries face unique challenges, including adherence to multiple tax regimes, management of diverse compliance requirements, and ensuring consistent payroll execution in different jurisdictions. The Crossbord® Solution provides a clear roadmap to overcome these obstacles, offering both proactive strategies and responsive support when regulations evolve or circumstances change.

Bespoke Crossbord® Services: Strategic Solutions for International Compliance Challenges

The Crossbord® Solution encompasses a suite of specialised services, each carefully designed to address specific compliance and operational challenges in cross-border contexts. These comprehensive offerings ensure organisations and their employees maintain seamless regulatory adherence whilst optimising processes and substantially reducing risk exposure. Each service element has been strategically developed to provide targeted support for the complex demands of international business operations.

Tax Briefing

Description

A detailed analysis of tax obligations, providing clear guidance on compliance with local and international regulations. This service identifies potential risks and opportunities, helping businesses make informed decisions.

Key Applications

Applications:

Used during project planning, employee relocations, and compliance evaluations.

Example:

Identifying permanent establishment risks for a project in Germany.

Social Security Support

Description

Comprehensive guidance on cross-border social security contributions and benefits, including application for A1/COC certificates to determine the applicable country’s system. It ensures employees and businesses meet their obligations seamlessly.

Key Applications

Applications:

Essential during employee onboarding, relocations, or when work patterns change.

Example:

Ensuring a Danish employee remains under Danish social security while working temporarily in France.

Danish Inbound Expat Tax Regime

Description

Support for businesses and individuals in applying for Denmark’s reduced tax scheme for researchers and high-income employees. This service includes eligibility assessment, application preparation, and compliance monitoring.

Key Applications

Applications:

Applied during inbound assignments to Denmark, particularly for high-level professionals.

Example:

Assisting a multinational corporation in securing forskerskatteordningen benefits for an executive relocating to Denmark.

Year-End Reconciliation

Description

A detailed review of payroll and tax data to ensure all compliance obligations are met. It involves correcting discrepancies, finalising reports, and preparing comprehensive documentation for authorities.

Key Applications

Applications:

Executed at fiscal year-end to prepare for audits or tax submissions.

Example:

Reconciling annual payroll data to ensure alignment with both Danish and international reporting standards.

Registration of Foreign Company in Denmark

Description

Expert assistance for foreign companies entering the Danish market, handling all legal and tax registration requirements. This service simplifies compliance and ensures smooth operations in Denmark.

Key Applications

Applications:

Relevant during market expansion or establishing a legal presence in Denmark.

Example:

Registering a US-based corporation with Danish tax authorities to facilitate operations in Copenhagen.

Hydrocarbon Tax Compliance

Description

Specialised support for businesses in the hydrocarbon sector, addressing complex regulatory requirements, including the Danish hydrocarbon tax framework.

Key Applications

Applications:

Applicable to energy projects in Denmark or internationally.

Example:

Ensuring compliance with all tax obligations for an offshore drilling operation in Danish waters.

Hiring Out of Labour

Description

Comprehensive advisory services for cross-border labor leasing, addressing tax and reporting obligations. This service helps businesses manage temporary workforce arrangements effectively.

Key Applications

Applications:

Used during project-based staffing in another jurisdiction.

Example:

Ensuring compliance with German labor leasing laws for a Danish company providing contractors to a German project.

Relocation Services

Description

End-to-end support for employees relocating internationally, covering tax registration, compliance, and integration into local systems. This ensures smooth transitions for employees and their employers.

Key Applications

Applications:

Relevant for permanent or temporary assignments abroad.

Example:

Assisting an employee moving to Sweden with social security registration and tax compliance.

Cross-Border Payroll Services

Description

Integrating payroll into The Crossbord Solution ensures that businesses remain compliant with all relevant regulations, both in Denmark and abroad. Cross-border payroll ensures that salaries are paid correctly and proper management of a range of legal frameworks, social security agreements, and tax treaties.

Key Applications

Applications:

Crucial for businesses operating internationally, ensuring compliance with local tax regulations, social security obligations, and labor laws across different countries. We handle the entire payroll process, including salary calculations, tax filings, and social security contributions.

Example:

A Danish company has employees working in Germany. The company uses cross-border payroll services to ensure compliance with German tax laws and social security regulations.

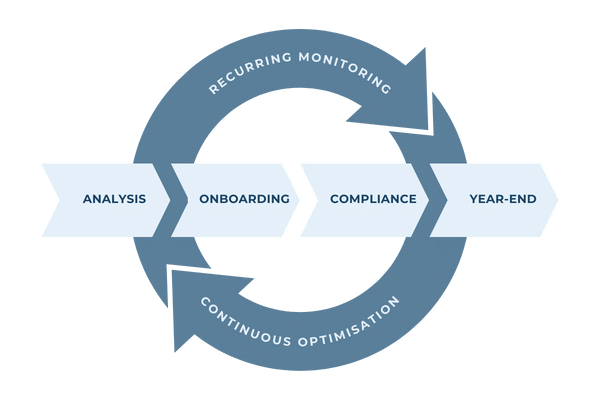

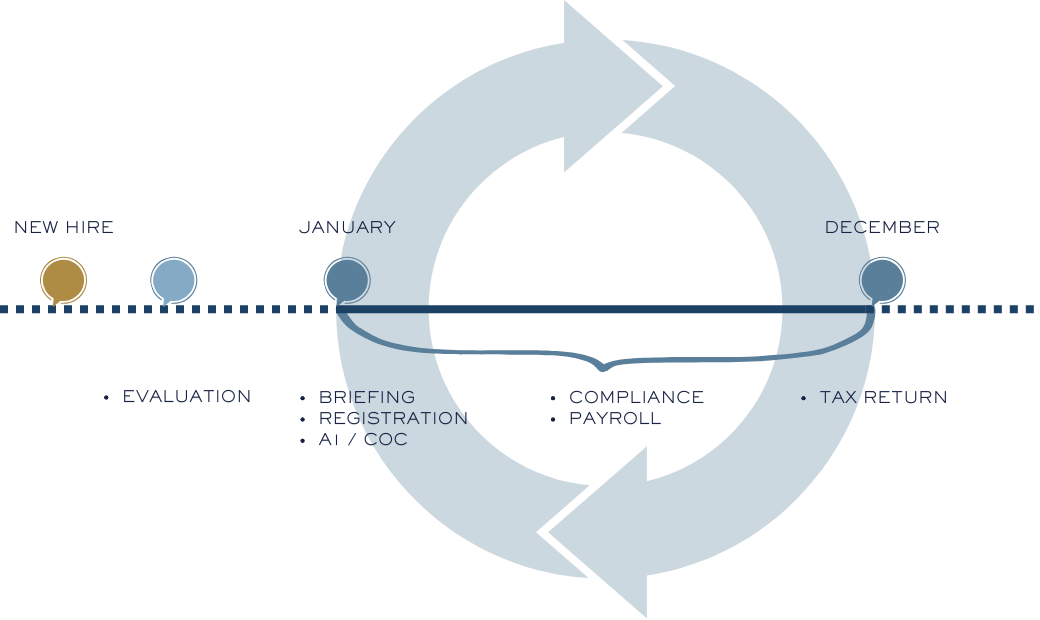

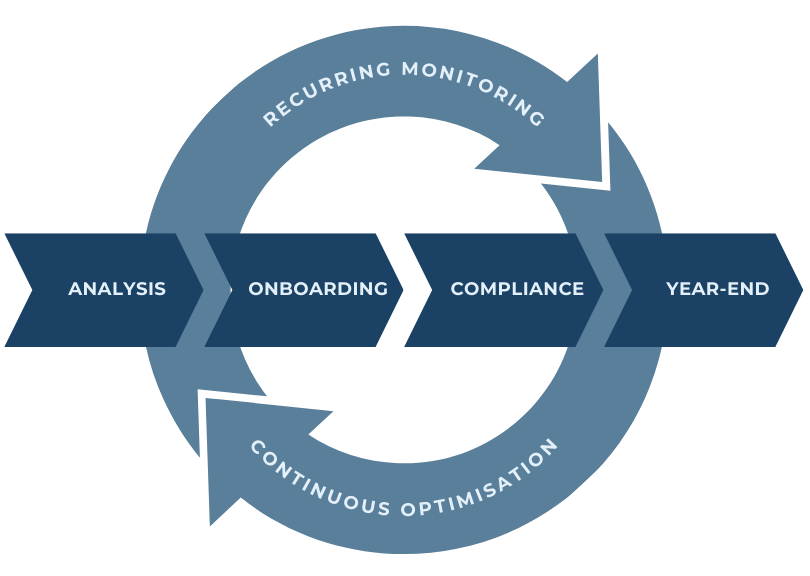

Analyse, Process, Review: A Streamlined Approach to Cross-Border Compliance

The Crossbord® Solution adheres to a simple yet effective methodology: analyse, process, and review. The process commences with a comprehensive analysis of your tax positions, compliance requirements, and data needs for each case or employee. This is followed by the processing of the necessary information and actions, which includes onboarding, reporting, and adjusting data in real time. The final stage involves a review of the results and the execution of the year-end reconciliation, utilising the data that has been meticulously collected throughout the year.

1. Evaluation

This phase involves a comprehensive analysis of tax obligations, social security requirements, and registration needs. Key actions include identifying permanent establishment risks, assessing labor leasing obligations, and determining the applicability of double taxation treaties. Detailed compliance strategies are developed to address these findings.

2. Ongoing Operations and Compliance

During this phase, payroll and compliance systems are set up and maintained to ensure regulatory adherence. Regular updates are made to align with changes in work patterns, tax laws, or jurisdictional requirements. Automated tools are often leveraged to streamline reporting and minimize errors.

3. Regular Reviews

Critical factors such as tax residency, work patterns, and compliance assumptions are reassessed periodically. Proactive adjustments are made to address any changes, ensuring the business or employee remains fully compliant throughout the year.

4. Year-End Reconciliation and Reporting

The final phase focuses on closing the fiscal year with accurate tax and payroll reporting. This includes preparing tax returns, reconciling payroll data, and ensuring all compliance requirements are met across jurisdictions. Comprehensive documentation is prepared for audits or inquiries from authorities.

The Crossbord® Solution offersCross-Border Tax Compliance Services

The Crossbord® Solution is our an all-encompassing cross-border tax compliance service designed to manage the intricacies of cross-border tax, payroll, human resources, and advisory services – our unique approach to handling cross-border tax and compliance issues. Our unique approach addresses cross-border tax compliance issues with precision and expertise. It is specifically tailored for businesses that are either dispatching or receiving employees to or from Denmark, thereby handling the complex and often time-consuming tasks of ensuring compliance, avoiding penalties, and establishing peace of mind for both the employer and the employees.

We begin each case with a comprehensive analysis of the tax positions, compliance requirements, and identification of necessary data for each employee.

Following the analysis, we conduct a thorough onboarding process to ensure compliance. This is typically an iterative process, where we receive information in real time, allowing us to take action or alert stakeholders, thereby avoiding any unfortunate situations or escalations.

The iteration concludes with the year-end reconciliation, for which we have collected data throughout the year. Our clients appreciate our process for its ease of execution and the peace of mind that comes from not having to worry about collecting all data at once, or the potential late fees or penalties that might arise from not adjusting data in real time.

Achieve seamless cross-border tax compliance

The Crossbord® Solution provides you with expert knowledge, delivers professional payroll services, and simplifies your communication with local authorities.

As specialists in cross-border tax, we go beyond providing advice; we take action on your behalf. The Crossbord® Solution is designed to help your business save time, effort, and potential expenses that would otherwise be spent on managing complex and often time-consuming tasks. We respond to your, or your employee’s, legal inquiries, and facilitate smooth interactions with the authorities for you.

Crossbord’s services do not solve every challenge international employees face. Cultural integration, language barriers, and family concerns remain. However, by eliminating the stress of navigating complex tax systems, Crossbord creates a smoother transition for employees and a more supportive environment for employers.

We ensure that your employees feel secure and supported throughout the process, allowing your business to operate smoothly and without any hindrances.

The Crossbord® Solution

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.