How to: Make Payments to the Danish Tax Agency

Should you find yourself in need of instructions on how to make payments to the Danish Tax Agency (Skattestyrelsen), here are some examples of various types of payment requests, where to make your payment, and how to contact the Danish Tax Agency.

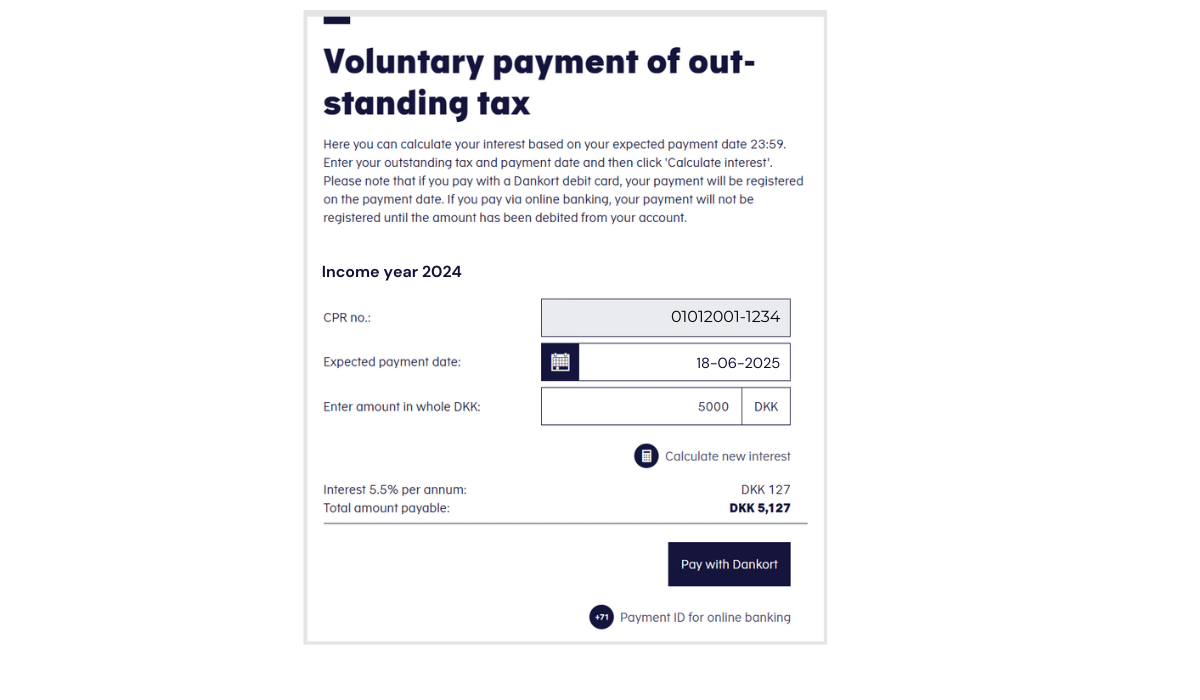

You can pay by dankort until 23.59 on the day of payment deadline. Or via online banking within the opening hours of your bank. This way your payment will be registered on the same day.

Please note that the deadline for optional payment of outstanding tax is 1st of July, 2025. If you pay before this date, your interest will be smaller and you will avout interest surplus. Outstanding tax for 2024 will be stated in your tax assessment notice which you can see from mid-March 2025.

Payment Deadlines

You can pay by card until 23.59 on the day of the payment deadline, or via online banking within the opening hours of your bank. This way your payment will be registered on the same day.

Please note that the deadline for optional payment of outstanding tax is on the 1st of July, 2025. If you pay before this date, your interest will be smaller and you will avoid surplus interest.

Tax payments for 2024 and before

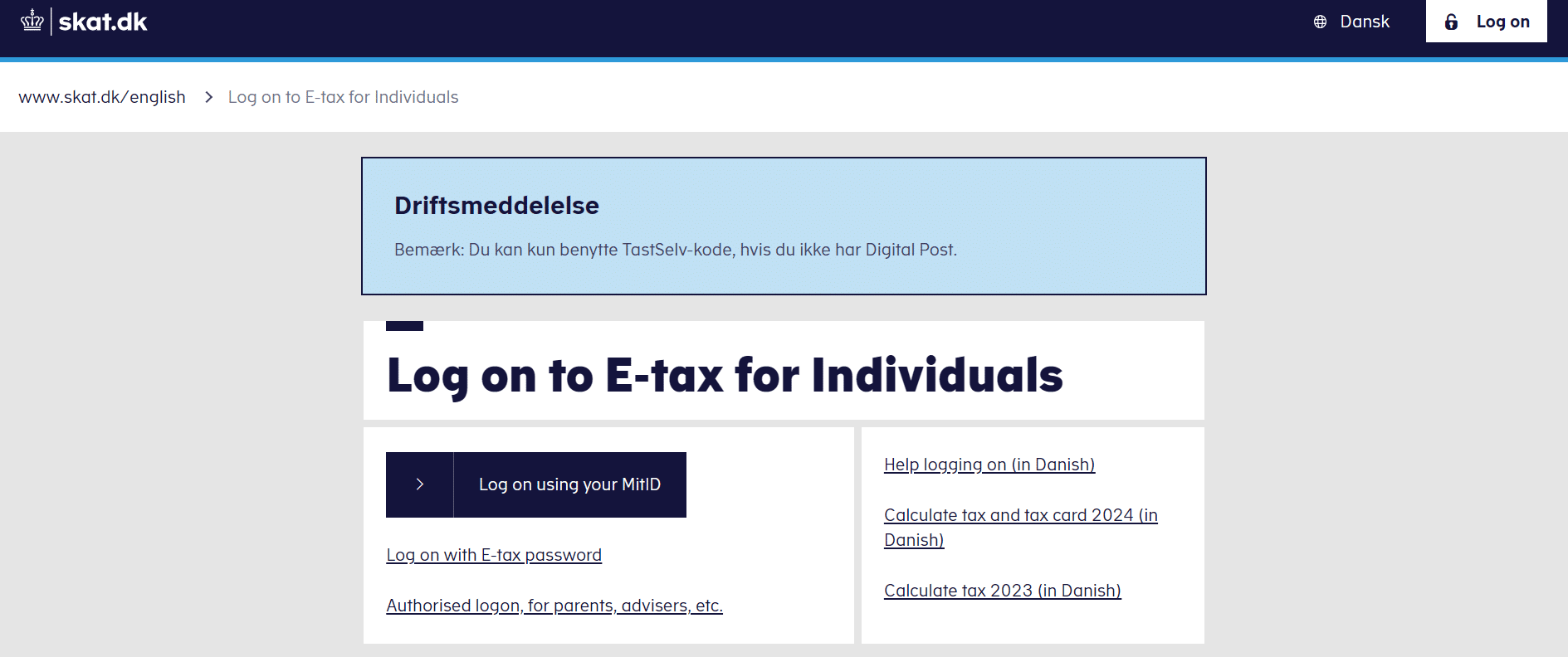

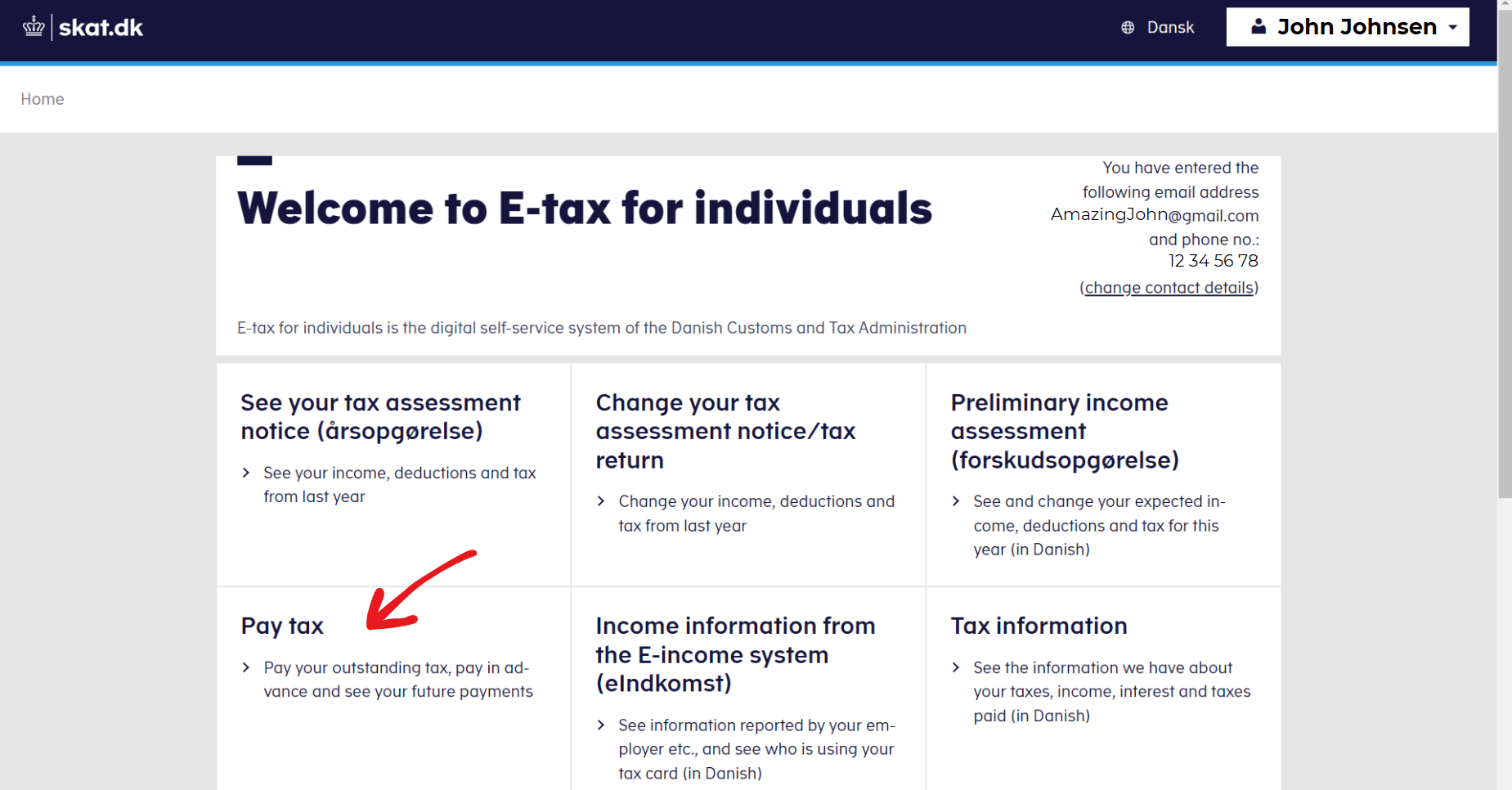

If you have paid too little tax throughout the year, you can see on your tax assessment notice that you need to pay the outstanding tax. Please log on to E-tax (TastSelv) to check your tax assessment notice for the relevant year.

You can pay outstanding tax in various ways, depending on the income year to which the outstanding tax relates. See your tax assessment notice to find out what applies to you.

Please note that you cannot pay your outstanding tax in a tax office

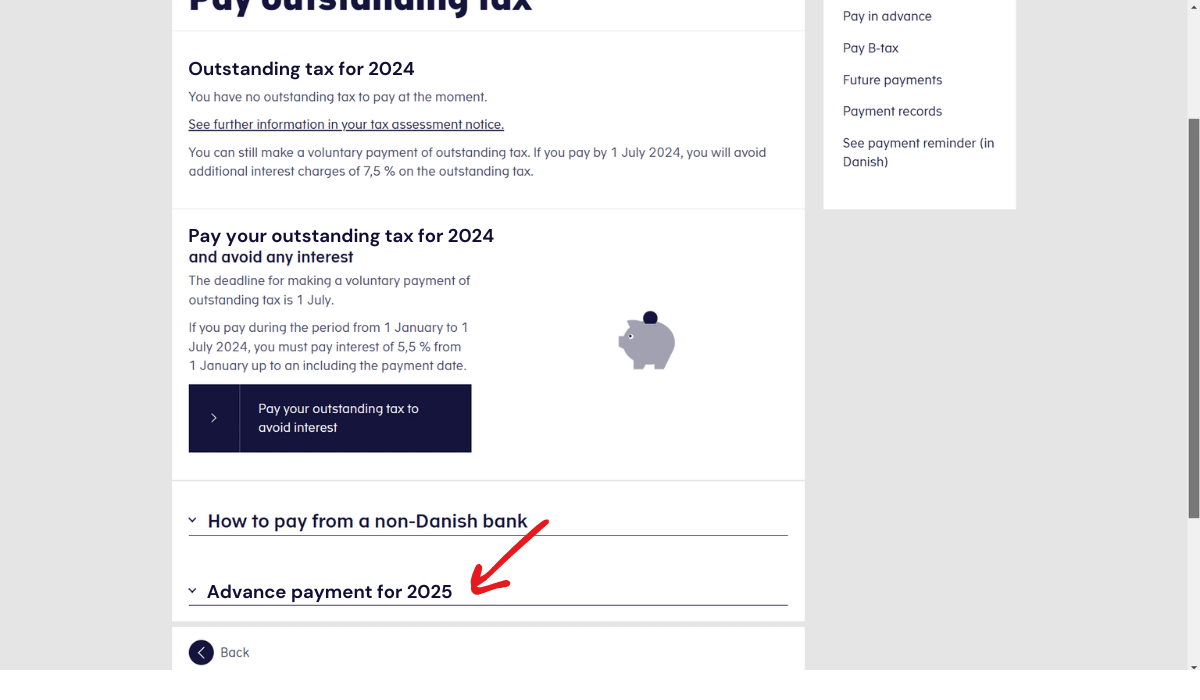

Pay outstanding tax for 2024

Outstanding tax for 2024 will be stated in your tax assessment notice which you can see from mid-March 2025 You can pay all or part of it via the payment option in E-tax.

Make your payment before 1st of July, 2025 and get a low interest rate

The deadline for paying by Dankort or payment ID via your online banking option is 1 July 2025. If you make your payment before this date, you will pay a low interest rate and avoid an interest surcharge.

When you pay your outstanding tax, it will be registered 2-3 working days after the day you pay. You can see your receipt in E-tax under ‘Betaling – Betalingshistorik’ (Payment – payment history).

If you use a payment card, it should be approved for online purchases. Please contact your bank or Nets for further information on approval for online purchases of payment cards.

Instalments

If your tax assessment notice states that you are to pay by instalments, it is important that you make your payment as prescribed. However, until the 1st of July, 2025, you may still make your payment as described above in the first point.

If you make your payment after the 1st of July, 2025 (fully or partially), you need to select Prepayment under Pay tax. This will only be accessible after 1 July 2025.

In certain cases, you may choose not to pay. In such case, your outstanding tax (maximum DKK 24,786) will be included in your preliminary income tax for 2025. Amounts in excess of DKK 24,786 should be paid as described in the two points above. If this option is available to you, it will be stated in your tax assessment notice

How to pay outstanding tax for 2024

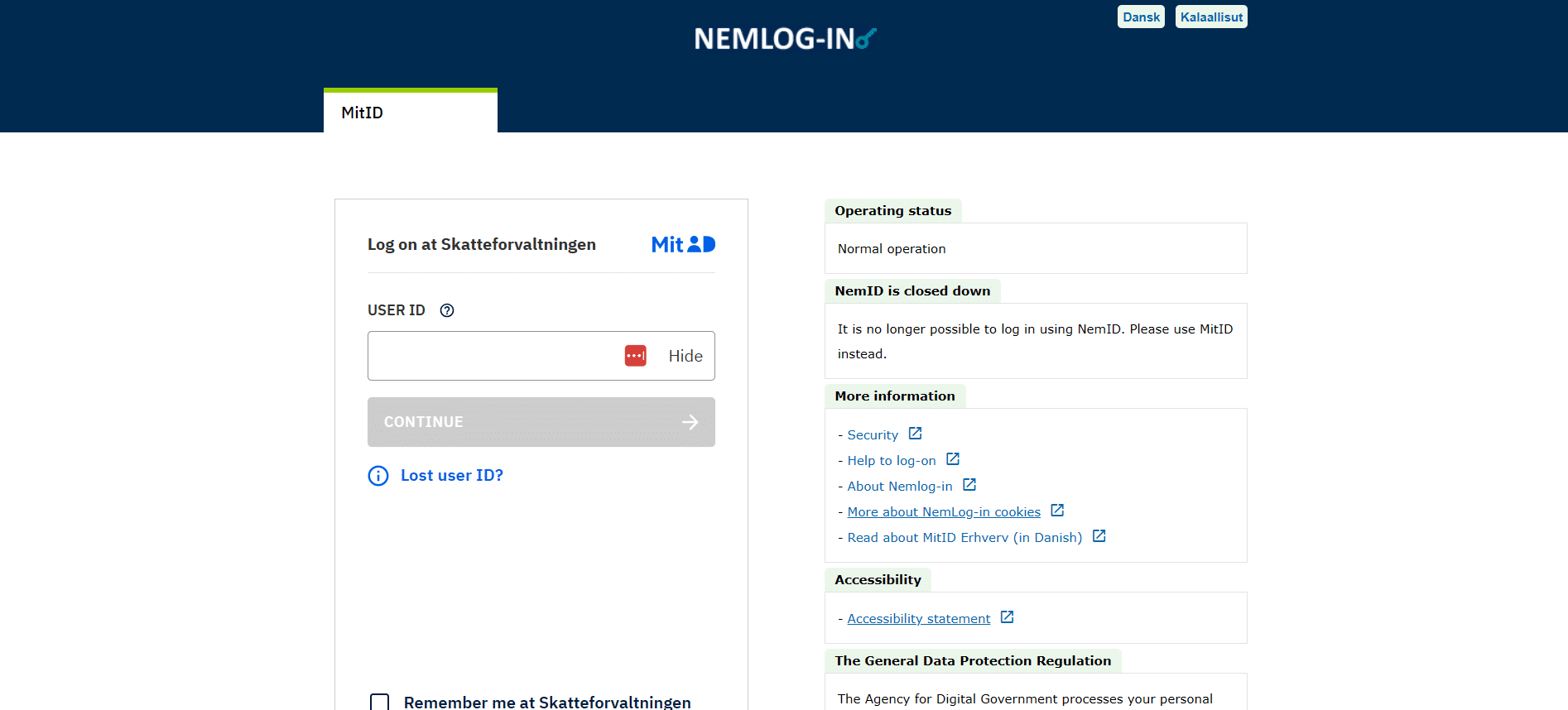

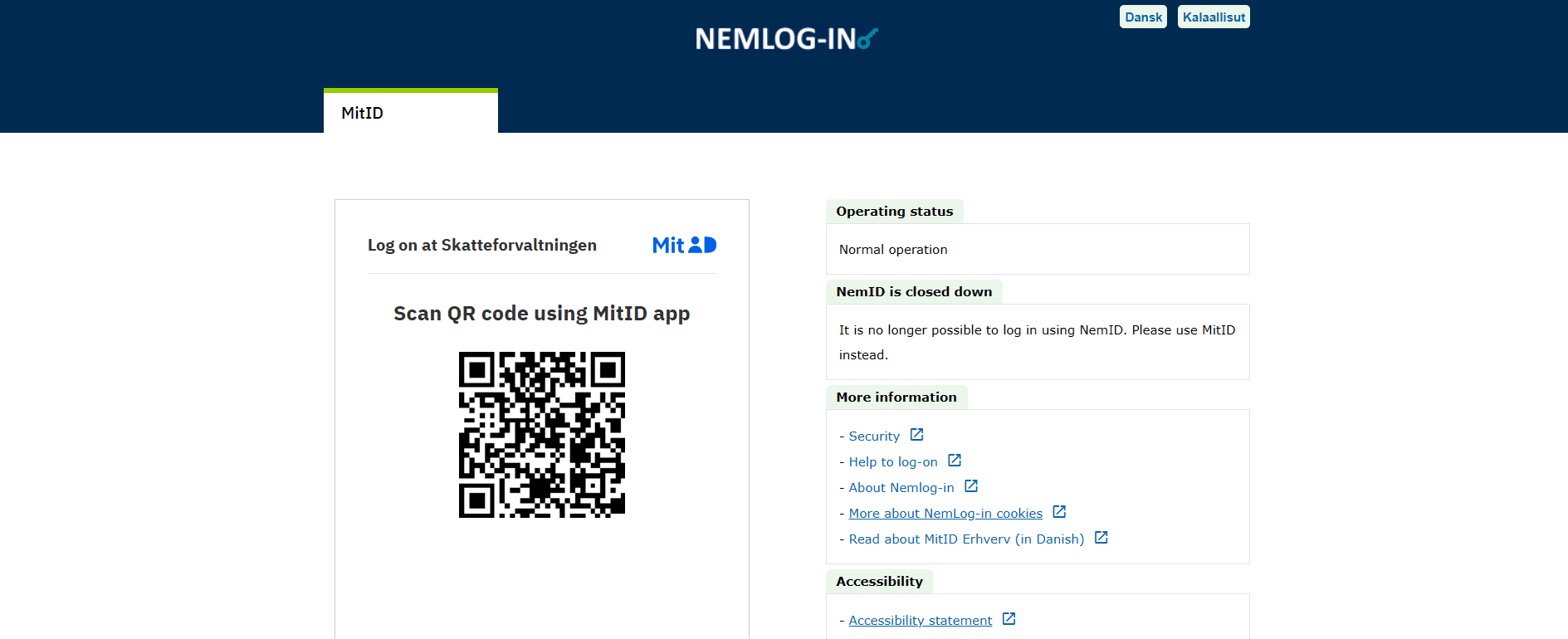

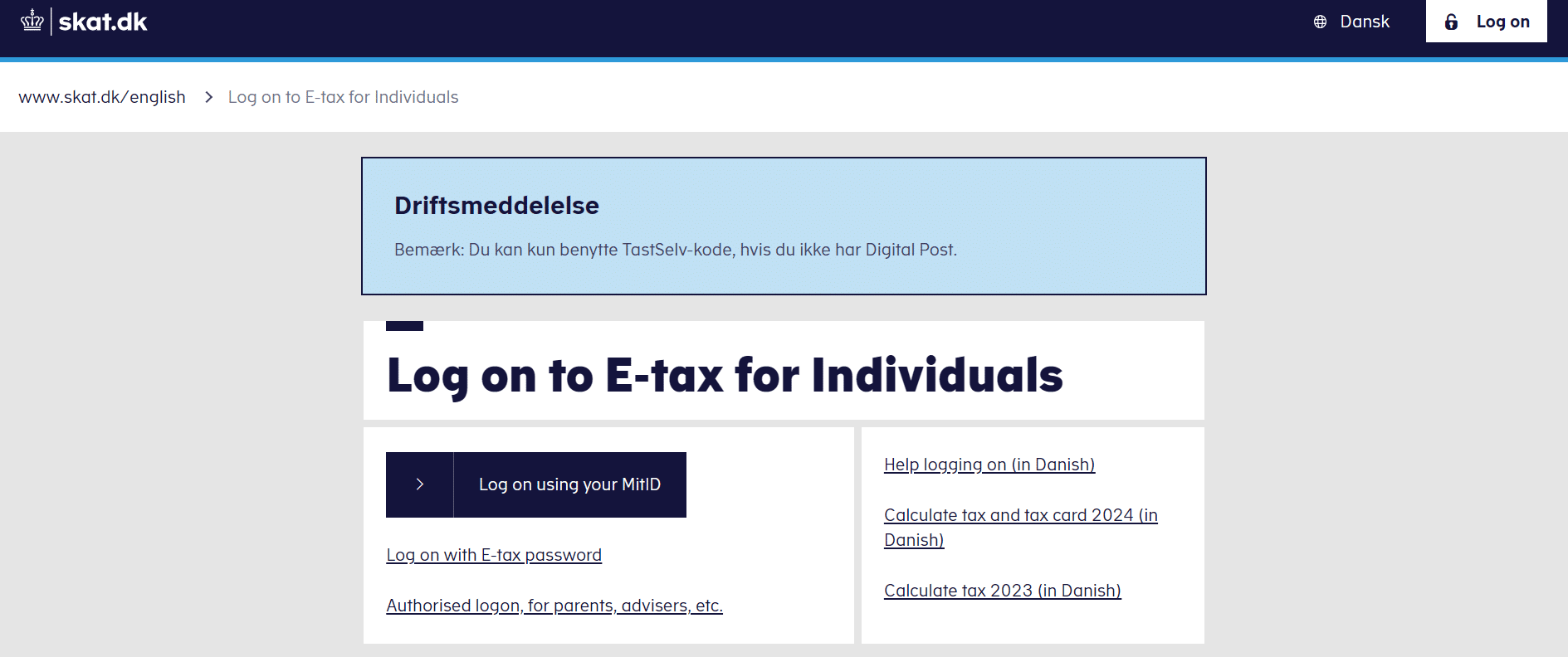

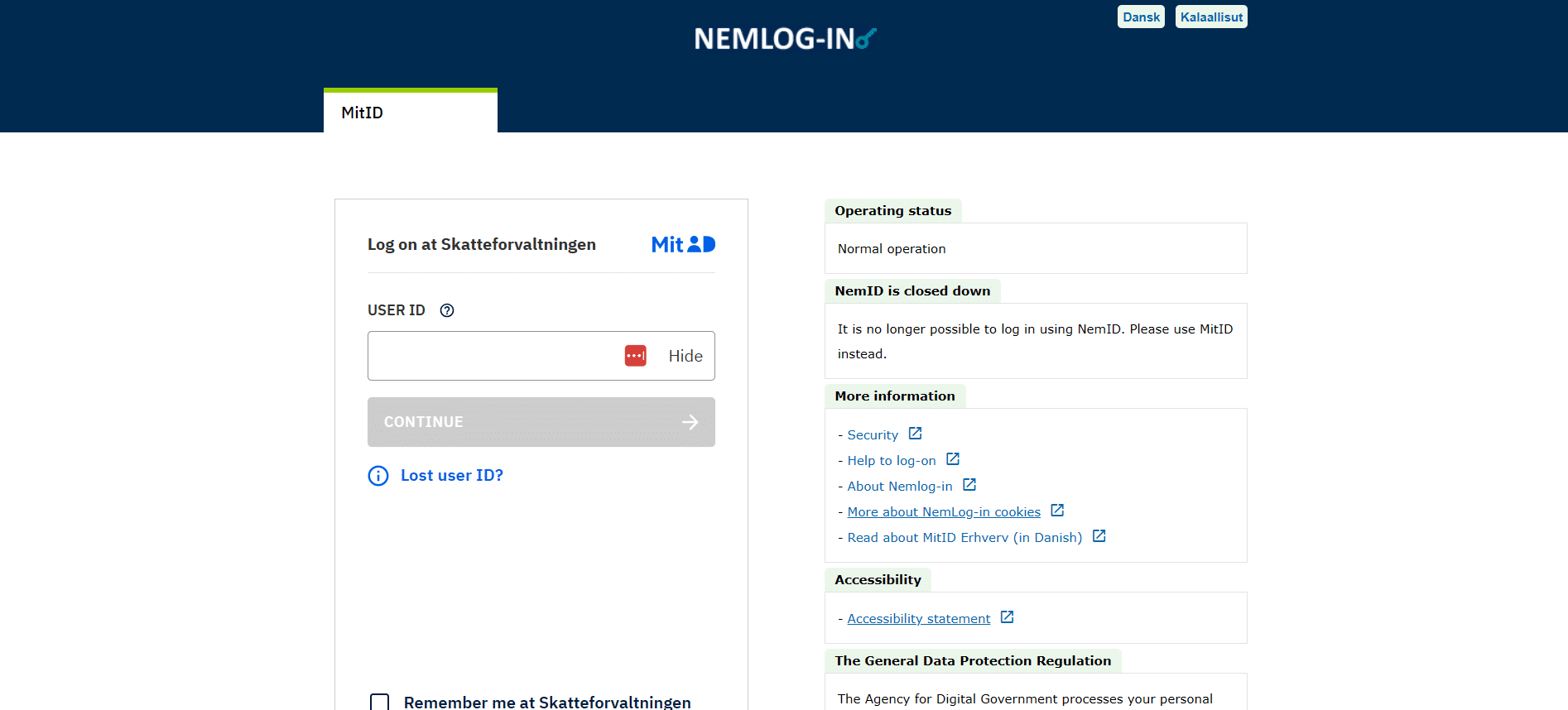

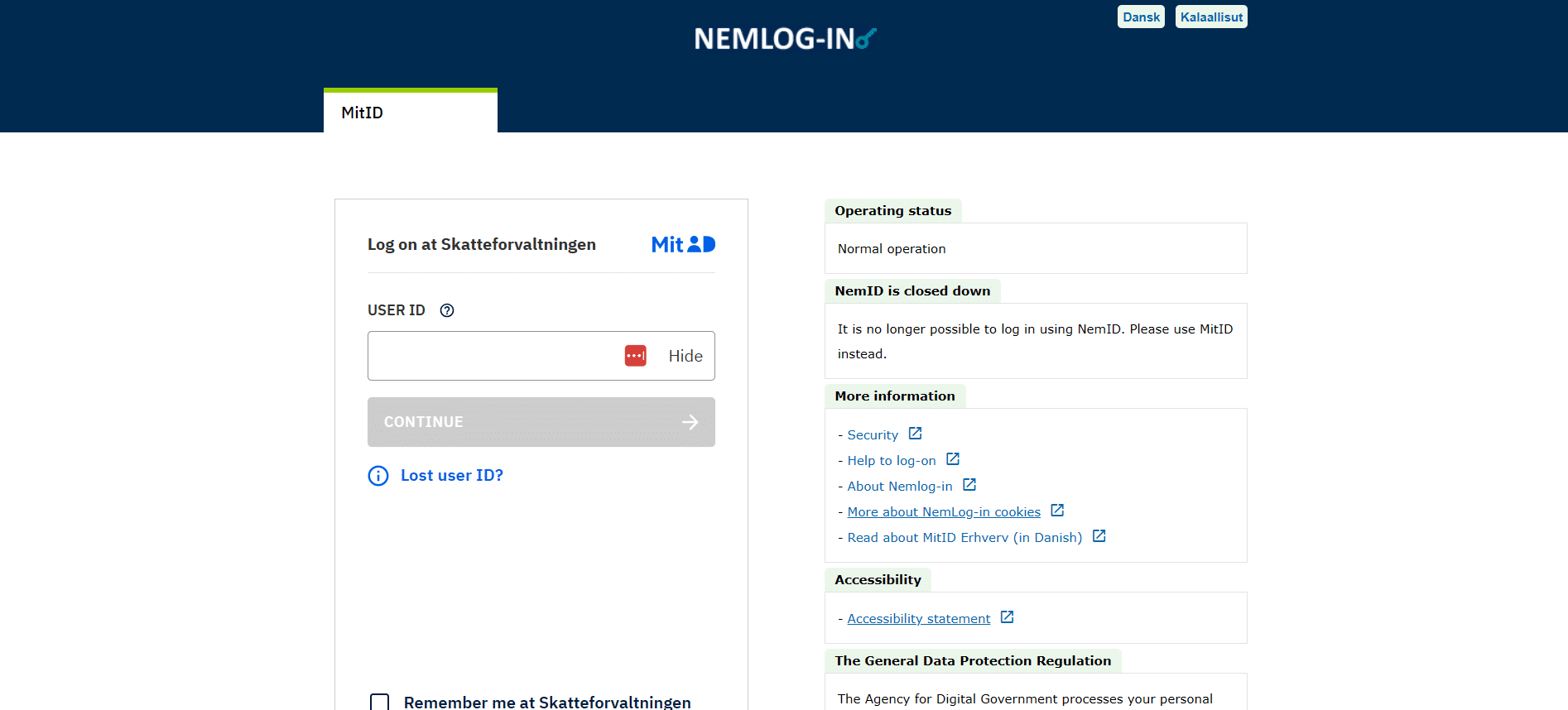

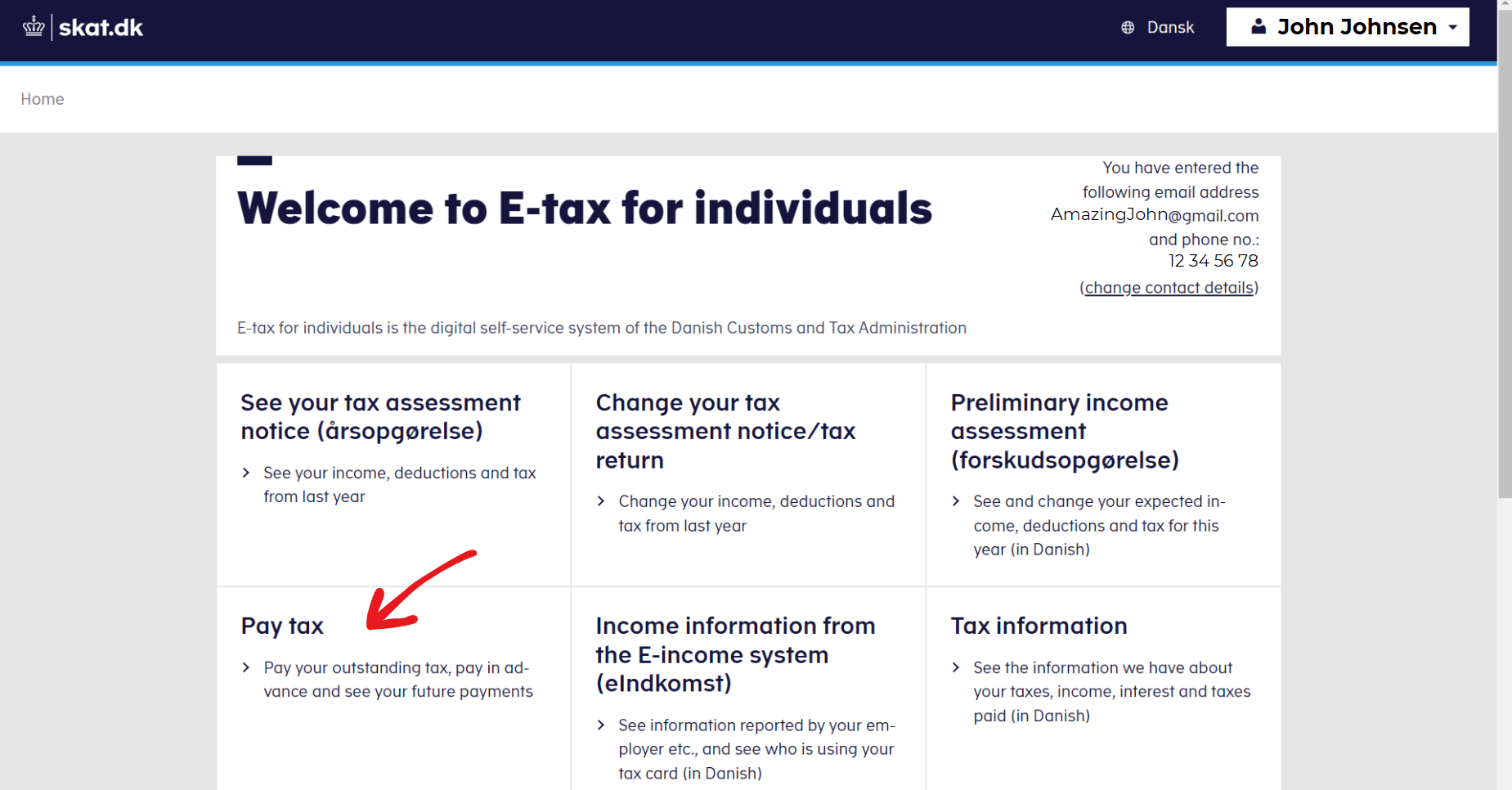

- Log on to E-tax (TastSelv)

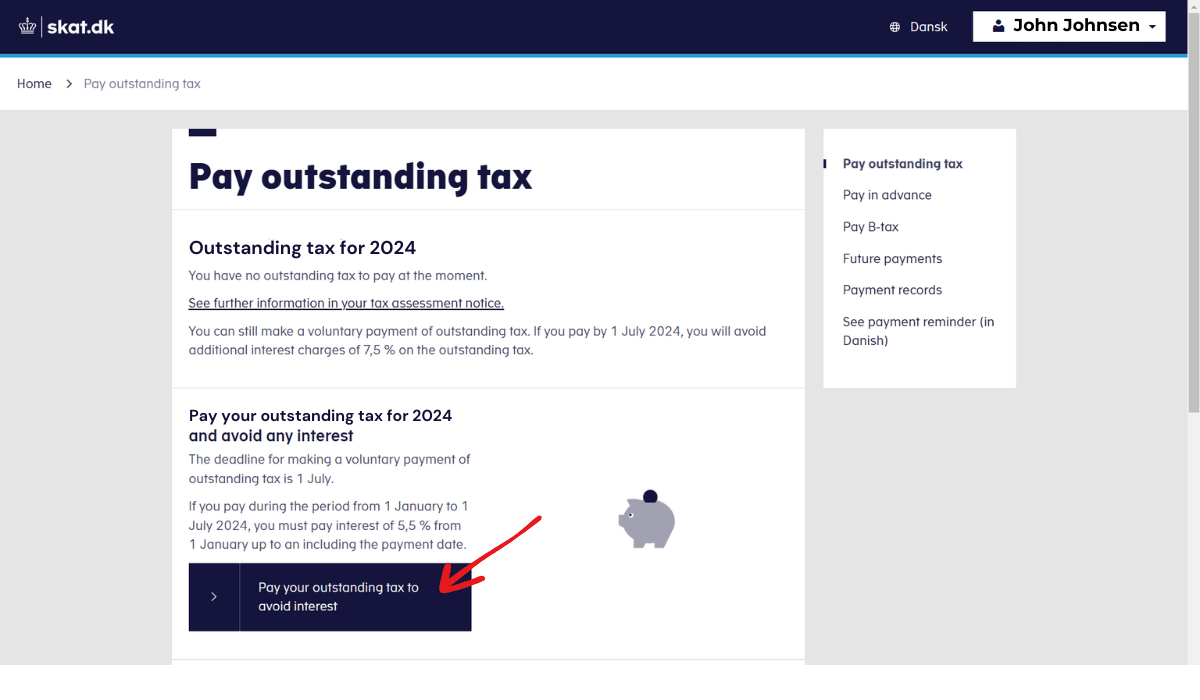

- Select Pay your outstanding tax to avoid interest

- A pop-up will emerge and you will be able to calculate the interest on your payment as well as continue on to the payment, which can be paid by card or via online banking.

Tax payments for 2025

The information stated in your preliminary income assessment is used to calculate your tax for 2024. Your employer, pension provider, etc. withholds A-tax (tax withheld from income at source) from your income, and you will not need to do anything yourself.

B-tax (tax not withheld from income at source), however, may also be payable in certain cases. If you have income such as fees or income from consultancy assignments, receive lump sums and/or other minor B-income, you need to pay B-tax on such income. Your preliminary income assessement will show if you have to pay B-tax.

In such cases, instalments will be generated and it is your responsibility to pay these instalments to the Tax Agency. You can do so by means of card or via your online banking.

How to pay B-tax

- Log on to E-tax (TastSelv)

- Select Pay tax

- Select Pay B-tax