Cross-border payroll services

Managing payroll across borders is a complex task that involves far more than just processing salaries.

It requires in-depth knowledge of tax regulations, social security obligations, and international compliance standards.

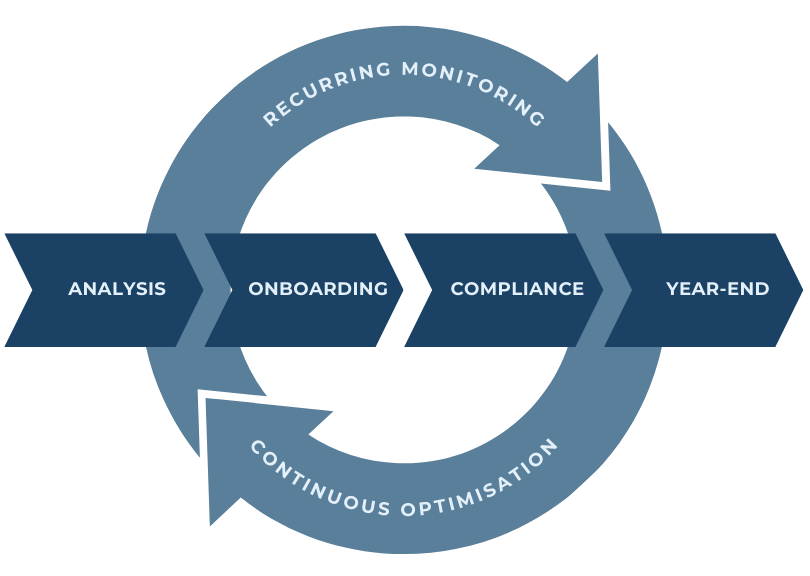

integrated into the Crossbord Solution

At Crossbord, we offer payroll solutions tailored to businesses operating across multiple jurisdictions, whether they are Danish companies with employees abroad or foreign companies with operations in Denmark. Our payroll services are fully integrated into The Crossbord Solution, allowing us to manage payroll, compliance, and tax obligations efficiently.

We provide a range of payroll services designed specifically for businesses that operate internationally, ensuring that all tax, compliance, and social security obligations are met across borders.

These include:

Full payroll outsourcing

We manage the entire payroll process, from calculating salaries to filing tax reports and handling social security contributions, ensuring compliance with Danish and international laws.

Shadow payroll

This service is ideal for companies based outside of Denmark that have employees working in Denmark. We ensure that tax and social security contributions are correctly reported in Denmark while maintaining the main payroll system in the home country.

Supplementary payroll support

For companies managing payroll in-house but needing assistance with cross-border employees, we offer expert support on compliance, tax optimisation, and reporting.

Partial payroll outsourcing

This service allows companies to outsource the payroll management for cross-border employees while retaining control of local payroll operations.

Foreign payroll conversion to Danish reporting

We convert foreign payroll systems into Danish-compliant reports, ensuring that businesses meet all their Danish reporting obligations without disrupting their main payroll processes.

Why integrate payroll in the Crossbord Solution

Integrating payroll into The Crossbord Solution ensures that businesses remain compliant with all relevant regulations, both in Denmark and abroad. Cross-border payroll is not just about ensuring that salaries are paid correctly; it also requires managing a range of legal frameworks, social security agreements, and tax treaties. With The Crossbord Solution, we simplify this complexity by handling payroll alongside other compliance and tax-related services.

A holistic approach to payroll

At Crossbord, we manage every aspect of payroll, from salary calculations and tax deductions to social security filings and compliance reporting. Our team of experts ensures that payroll processes are fully compliant with the regulations of both Denmark and the countries where your employees are based. We also work proactively throughout the year, monitoring payroll data to ensure that any changes in tax law or employee status are accounted for in real time, preventing costly errors and penalties.

Shadow payroll for cross-border employees

One of the key services we offer as part of The Crossbord Solution is shadow payroll. This service is essential for companies with employees who live in one country but work in another. Shadow payroll ensures that these employees remain compliant with the tax and social security laws of both their home country and the country where they work. This service is particularly beneficial for expatriates, executives, and employees who frequently move between jurisdictions.

Foreign payroll conversion to Danish reporting

Many companies that operate internationally may manage their payroll outside Denmark but still need to meet reporting obligations within the country. Our foreign payroll conversion service ensures that all payroll data is correctly reported to Danish tax authorities, converting foreign payroll systems into Danish-compliant reports. This service allows businesses to maintain their existing payroll systems while ensuring compliance with Danish regulations.

Social security and tax compliance for international employees

Handling social security contributions and tax liabilities for employees working across borders can be challenging. At Crossbord, we ensure that all contributions are managed correctly, taking into account international social security agreements and tax treaties. This ensures compliance with local and international laws while optimising tax positions for both employees and employers. Our services are designed to provide peace of mind by ensuring that all tax and social security obligations are met in full.

Not just another Payroll

Different companies have different requirements, and we understand that. To ensure our payroll services meet all your needs, we use a range of systems tailored to specific situations.

Below are the main systems we employ.

Zenegy is a modern, digital payroll and HR platform designed to simplify and streamline company processes.

Danløn is a reliable online payroll system designed to make payroll and HR tasks simple and efficient for businesses of all sizes.

LessorLøn is a comprehensive and automated payroll solution designed to ensure accuracy and efficiency in every pay run.

Ready to optimise your payroll?

Integrating payroll into The Crossbord Solution provides a comprehensive, tax-efficient approach to managing cross-border payroll. With our expertise in international tax law, social security agreements, and payroll management, we ensure that your business remains compliant while optimising operational efficiency. Contact Crossbord today to learn how we can tailor our payroll solutions to fit your specific needs and help your business succeed in an increasingly complex global market.

The Crossbord® Solution

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.