Discover Expert Global Mobility Solutions for Seamless Cross-Border Operations

At Crossbord, we specialise in delivering top-tier global mobility services to international businesses, and offer seamless expat tax, payroll, and compliance services for cross-border needs.. Our mission is to facilitate seamless operations across borders by simplifying the interactions between businesses, their employees, and local authorities. With our comprehensive solutions, we ensure that your global workforce is managed efficiently and compliantly, allowing you to focus on your core business activities.

Our Services

The Crossbord Solution

Crossbord’s services don’t solve every challenge international employees face—cultural integration, language barriers, and family concerns remain. However, by eliminating the stress of navigating complex tax systems, Crossbord creates a smoother transition for employees and a more supportive environment for employers.

Read more about The Crossbord Solution.

Tax Briefing

Our Comprehensive Tax Analysis Service offers detailed insights into your employee’s tax obligations, ensuring clear guidance on compliance with both local and international regulations. This service meticulously identifies potential risks and opportunities, empowering businesses to make well-informed decisions.

Read more about Tax Briefing.

Year-End Reconciliation

Our Comprehensive Payroll and Tax Review Service ensures that all compliance obligations are met through a meticulous review of your payroll and tax data. This service includes correcting discrepancies, finalising reports, and preparing comprehensive documentation for authorities.

Read more about Year-End Reconciliation.

Danish Inbound Expat Tax Regime

Our Reduced Tax Scheme Application Support assists businesses and individuals in applying for Denmark’s reduced tax scheme for researchers and high-income employees. This service includes a thorough eligibility assessment, meticulous application preparation, and ongoing compliance monitoring.

Read more about Danish Inbound Expat Tax Regime.

Foreign Company Registration In Denmark

Our Danish Market Entry Support provides expert assistance for foreign companies entering the Danish market. We handle all legal and tax registration requirements, simplifying compliance and ensuring smooth operations in Denmark.

Read more about Foreign Company Registration In Denmark or The RUT Register: Compliance For Foreign Service Providers.

Hydrocarbon Tax Compliance For Offshore Operations

Our Hydrocarbon Sector Support offers specialised assistance for businesses in the hydrocarbon industry. We address complex regulatory requirements, including the Danish hydrocarbon tax framework, ensuring your operations remain compliant and efficient.

Read more about Hydrocarbon Tax Compliance For Offshore Operations

Hiring Out Of Labour

Our Cross-Border Labour Leasing Advisory provides comprehensive support for businesses managing temporary workforce arrangements across borders. We address all tax and reporting obligations, ensuring your operations remain compliant and efficient.

Read more about Hiring Out Of Labour.

Social Security Support Service

Our Cross-Border Social Security Guidance provides comprehensive support on social security contributions and benefits across borders. This service includes the application for A1/COC certificates to determine the applicable country’s system, ensuring that both employees and businesses meet their obligations seamlessly.

Read more about Social Security Support Service.

Relocation Service

Our International Relocation Support provides end-to-end assistance for employees relocating internationally. We cover tax registration, compliance, and integration into local systems, ensuring smooth transitions for both employees and their employers.

Read more about Relocation Service.

Cross-Border Payroll Service

Our Cross-Border Payroll Service provides a range of payroll services designed specifically for businesses that operate internationally, ensuring that all tax, compliance, and social security obligations are met across borders.

Read more about Cross-border payroll.

Crossbord is experienced with tax advisory services and specialises in expatriation. Our global mobility solutions services are designed for every level and step in the global mobility process. Every situation is special but in broad strokes the process falls under either planning the assignment, ongoing support (while an employee is on assignment), or follow up after the assigment has ended.

Beyond these core services, we also assist with additional services including permanent establishment (corporate taxation), and more. If you do not see a solution that fits your situation perfectly, reach out to see how a bespoke solution can be tailored to your unique needs.

Your Trusted Partner in Global Business Compliance

We bridge the gap between businesses, employees and authorities, delivering bespoke solutions that encompass expert tax guidance and vigilant case monitoring—whether you operate in Denmark or worldwide.

From business formation to seamless payroll management, we’re by your side at every step. Our comprehensive support ensures your enterprise remains fully compliant, even amid the most intricate regulatory landscapes.

Gone are the days of fragmented global mobility solutions. We’ve revolutionised our approach by seamlessly integrating tax advisory, compliance oversight and payroll administration. By uniting expertise with execution, we safeguard your compliance whilst you focus on growth.

Testimonials

“Thanks for your fantastic support throughout this “journey” and for always being available when reaching out. It is much appreciated!”

“Thank you for your help with the tax card applications, all employees have been adjusted to the correct rate. Additionally, the process of applying for CPR is now much improved.”

“We are sending thanks to the entire team for the great assistance, we are beyond relieved that the incorrect statement has been cleared up.”

Effortless cross-border tax compliance with the Crossbord® Solution

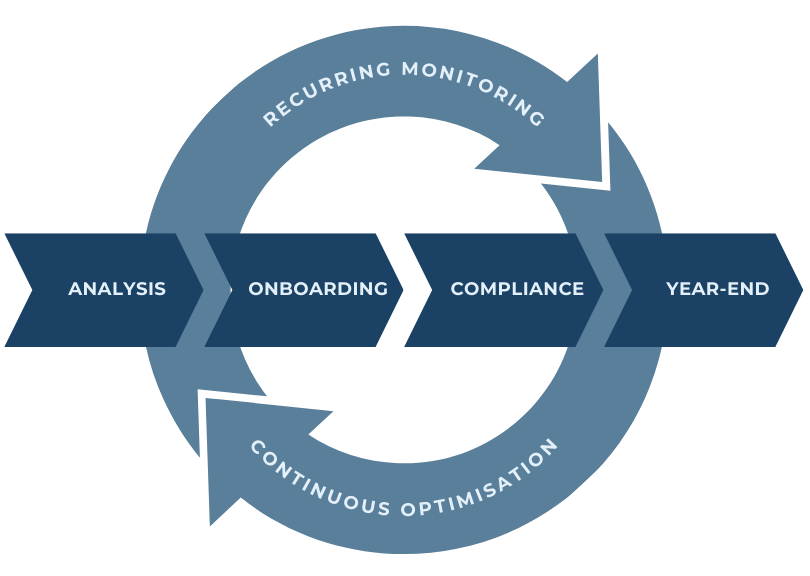

The Crossbord® Solution is a comprehensive global mobility solution carefully designed to navigate the complexities of cross-border tax compliance, payroll, and human resources. Our unique approach addresses cross-border tax and compliance issues with precision and expertise, specifically tailored for businesses dispatching or receiving employees to or from Denmark.

We follow a simple yet effective methodology of analysing, processing, and reviewing each case to ensure seamless compliance, mitigate penalties, and foster peace of mind for both employers and employees. From onboarding to year-end reconciliation, we handle the intricate and often time-consuming tasks, freeing you to focus on your core business.

Our experts handle the complexities so you don’t have to. Read more about the Crossbord Solution

We fully understand your unique tax situation and explain it to you in plain, easy-to-grasp terms.

We carefully review your reporting requirements and other needs specific to your international staff.

Backed by deep expertise, we handle any necessary changes on your behalf with ease.

You can count on our precise reporting to keep you compliant, while your employees receive accurate year-end documents.

Core services

Expert Tax Guidance

payroll services

We assist international clients with Danish payroll ranging from handling the entire salary process to reporting to the various mandatory authorities in Denmark.

A part of our service entails identifying and implementing tax saving opportunities, worldwide withholding, and reporting requirements for employers and their employees regardless of natioanlity.

We also advice and assist in establishing (adapted shadow) payrolls to ensure that filing and reporting requirements are met.

Partner of ActivPayroll

Crossbord is the Danish partner of the award-winning activpayroll, a leading global professional service organisation, which provides integrated global and domestic payroll solutions; expatriate taxation services and online HR people management tools to over 1000 companies in more than 120 countries worldwide.

With global headquarters in Aberdeen, UK, and a number of key offices around the globe, activpayroll has one of the largest and most experienced international payroll and expatriate tax teams in the world.

Activpayroll is an SSAE 16 & ISAE 3402 Type II approved organisation and holds the highest level of BACS accreditation available.

HR services

Global Mobility can be challenging in a number significant ways that impacts both your business and employees.

We offer a range of supplementary services linked to the task of administrating a global cross-border workforce.

We provide insight and assistance on the following areas:

- Employment contract, services letters, assignment letters etc.

- HR policies

- Danish labour law

- Permits and visas

- Foreign company registrations (e.g. RUT)

- Assistance when communicating with public authorities, etc.

Why social security matters

Your global workforce also needs social security as it determines what types of coverage the individual will have in various situations of life, e.g. illness, retirement, death, maternity or paternity, work related accidents, etc.

Most often countries will have systems in place to ensure each individual a certain level of social security, and these are typically financed through direct contributions from employers to authorities/funds or via taxes paid.

The Crossbord® Solution

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.