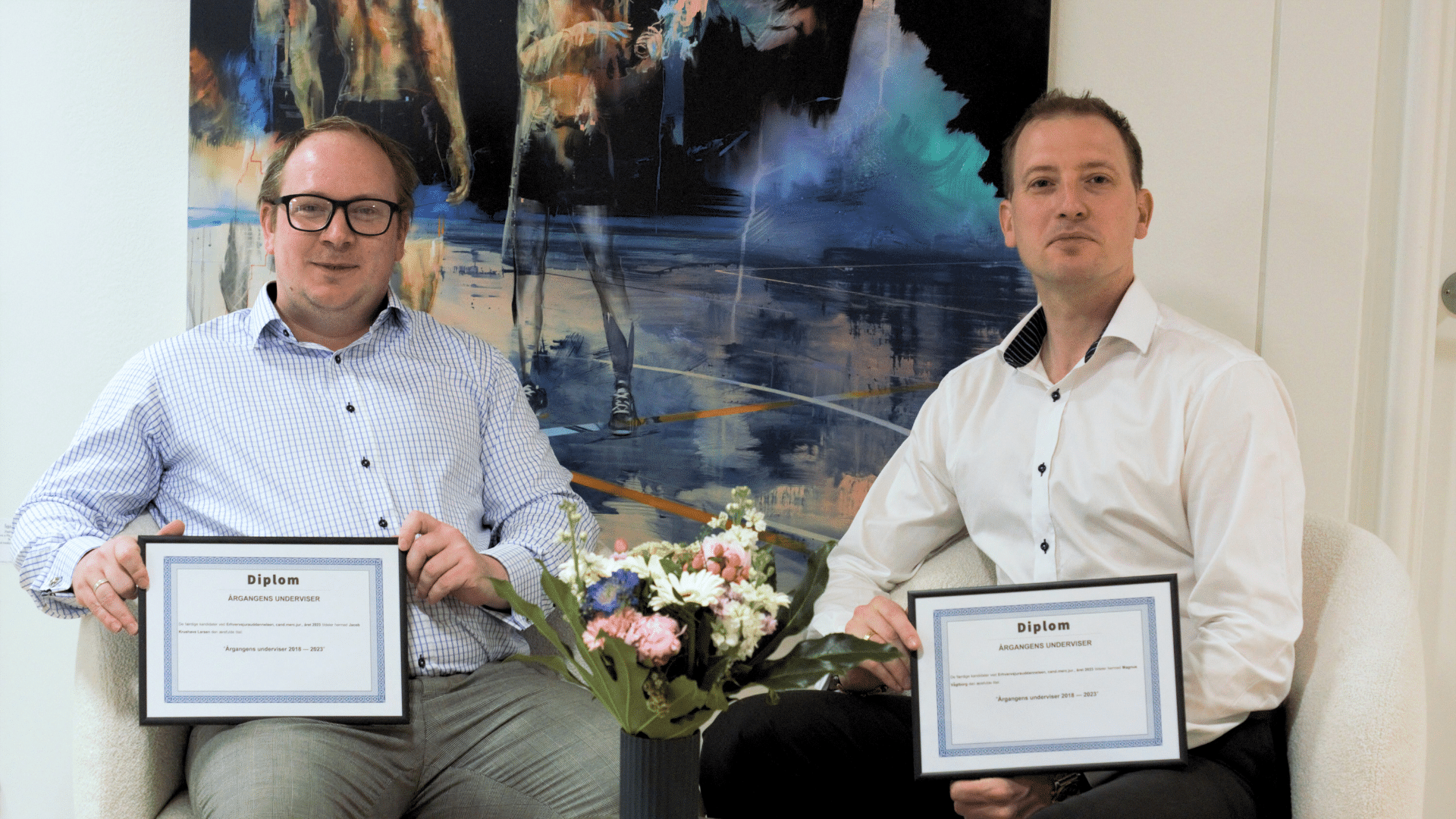

The best of the best

Jacob Krushave and Magnus Vagtborg have been teaching as external lecturers at The Faculty of Law at Aalborg University for many years. This year, as several other, they have been awarded with, amongst other the award of The Best Lecturer by the Class of 2023 Master of Science (MSc) in Business Law. We’d like to wish the 2023 graudates congratulations with their degrees, and our colleagues with their awards.

Magnus was invited to speak to the new graduates and he, of course, had some wise words of advice to pass on to the graduates. He said:

“Husk at vælge noget, hvor hjertet går begge veje – find nogen, der vil dyrke dig. Gør det klart allerede nu, hvor meget du vil finde dig i – man kan ikke se det, når man står i det. Husk at livet leves især udenfor arbejdet.“

Which translates approximately to:

“Remember to choose something where the love goes both ways, find someone who’ll help you grow. Make up your mind about how much cr*p you’ll accept, it might be hard to recognise when you’re in the middle of it. Remember that life, especially, is lived outside of work.“

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord