Give your employee one less head-ache

Moving to Denmark can be hard

Moving to a new country can be both an adventure and an arduous task for your employees – from finding a new home and moving their belongings, finding school or daycare to their kids, enrolling in a good language school, and declaring taxes properly, dealing with income from several countries, interest rates and stocks, while avoiding fees and double taxation situations where possible.

With the Crossbord Foreign Employee Solution you can help your employee to have one less head-ache: tax

The crossbord foreign employee solution

Basic

- Crossbord reviews the information to be filed for your employee

- Your employee feels confident to handle their taxes themselves

- Walk through of year end statement

Advanced

- Crossbord assists in the process for your employee

- Your employee would like to do some of the work themselves

- Your employee gets assurance that the necessary information is filed correctly

Premium

- Crossbord takes charge of the entire process for your employee

- Your employee would like to be minimally involved

- Your employee wants to have everything handled by a professional

your employees are ensured

- That all their obligations towards the Danish Tax Agency are met

- A favourable price

How does it work?

- Your employee pays for the chosen service through a deduction in their net salary

- Crossbord will be in direct contact with your employee, i.e., there will be no need for your company to act as a middle man in distributing information or answering questions

Understanding the Danish income tax cycle

What is it?

preliminary income assessment (forskudsopgørelse)

The preliminary income assessment is the Danish Tax Authority’s calculation of your income for the coming year and how much you should pay in taxes.

- Budget

- Relevant for the coming year

- Can be adjusted throughout the year

Tax Return (Årsopgørelse)

Your financial statement for the previous year, where you can see how much you have actually earned and paid in taxes.

- Financial statement

- Relevant for the previous year

- Settled once a year

What happens when?

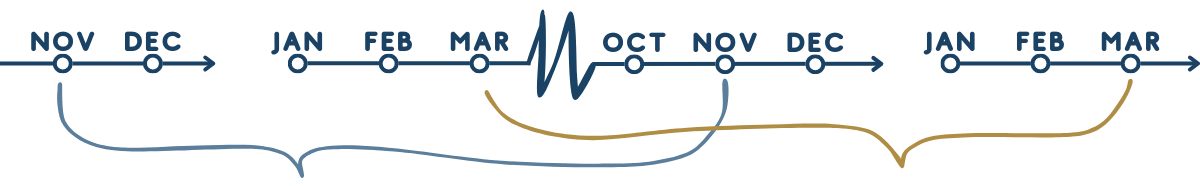

preliminary income assessment

You can see your preliminary income assessment on skat.dk/tastselv every year medio November.

Tax Return

You can see your tax return on skat.dk/tastselv every year medio March.

preliminary income assessment

Adjust your preliminary income assessment when it becomes available, or if you:

- Get a salary raise / decrease

- Have days working from home

- Obtain a loan

- Start / close down a company

Tax Return

Check your tax return to see if you get money back or need to pay residual tax:

- Double check that your information is correctly reported

- Make changes if your information is not correct

Get year end assistance

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.

® – 2024. All rights reserved. Crossbord

® – 2024. All rights reserved. Crossbord