Øresundsaftalen: The Cross-border Agreement between Denmark and Sweden

Every day 18,000 people commute between Denmark and Sweden, and cross-border work continues to evolve in nature as more people work remotely and seek flexibility in how and where they perform their jobs. The Øresund Agreement modifies the Double Taxation Agreement among the Nordic countries and specifically applies to the relationship between Denmark and Sweden. This agreement alters the jurisdiction that has the right to tax a salary when the salary is earned by an individual working in both countries.

Note: the agreement has been revised, read in depth about the changes here: New Øresund Agreement: Simplified Taxation for Cross-Border Workers and Employers

When is the Cross-border Agreement relevant?

The Cross-border Agreement for the Øresund region is relevant for you as a Danish employer when:

- You have hired an individual living in Sweden

- The individual already works / or would like to work from home (in Sweden)

Worth keeping in mind

A cross-border worker will primarily be taxed in the country where their employer is based, regardless of whether the work is carried out in that country or remotely from their home country. This means that an individual working from their home office in Sweden for a Danish employer, will be considered as working in Denmark from a double tax perspective if they typically perform their work in Denmark (physically).

The term “usually working in Denmark” is defined as working a minimum of 50% of the time over a 12 month period (from January 1st, 2025). Sporadic business trips and holidays will typically also be considered as work carried out in Denmark.

Workers can perform their duties from any location within their home country, including places such as a co-working spaces or a cafés, and still qualify for the tax exemption.

Public-sector employees are now included, meaning public servants working for Danish or Swedish government institutions can also work from home without facing double taxation. Previously, only private-sector workers benefited from tax exemptions when working from home.

The agreement does not apply if the work in Sweden is performed at an office location owned by the employer. Similarly, if the work is carried out in a location that is a permanent establishment, the agreement does not apply.

Employer obligations

As a Danish employer, you are obligated to report the salary paid to an individual on a monthly basis. If the individual is covered by the Øresund agreement, or is physically working in Denmark, you also have a responsibility to withhold Danish taxes.

Even if the individual is not covered by the Øresund agreement, you are still required to report the salary paid. However, it will likely be reported as tax-free. Therefore, no taxes should be withheld when the individual is not physically working in Denmark. This is subject to a specific evaluation in each case.

Social security

The primary rule on social security is as follows:

- An individual is generally covered by social security in the state where they are employed. If an individual works in multiple states, they are socially secured in their home country if they work there at least 25% of their time.

- However, for individuals covered by the Øresund agreement on social security, it is possible to apply for a ruling to increase this 25% threshold to 50%, aligning it with the taxation requirement.

To ensure clarity on which country’s social security legislation covers your employee, a request (A1) should be submitted to the authorities. Crossbord can assist in evaluating your employee’s social security status and in submitting an A1.

Pension Taxation

Contributions made to a pension scheme in one country are deductible in the other. Danish workers contributing to a Swedish pension scheme can deduct those contributions from their taxable income in Denmark, and vice versa. This also means that pensioners receiving payments from schemes in one country will remain taxable on those payments in their home country, preventing double taxation on pension income.

Taxation of Educational Grants, Scholarships, and Artist Support

Tax treatment of educational support, scholarships, and artist grants are harmonised in the new agreement. Support provided by either government will be taxed only in the country providing the grant or support, provided it would have been tax-exempt if the recipient had lived in the country of origin.

Example: A recipient of Swedish educational grants living in Denmarkis not taxed on this income in Denmark if it would not have been taxed in Sweden.

Revenue Sharing Between Denmark and Sweden

A revenue-sharing mechanism is introduced to aboid revenue loss in the home country of the cross-border worker. Denmark and Sweden will exchange a portion of the tax revenue collected from cross-border workers to ensure that both countries benefit from income tax contributions. This exchange will apply to both public and private sector employees and will be calculated based on a new threshold of DKK 210,000, which will be adjusted annually for inflation.

How can Crossbord assist in cases like this?

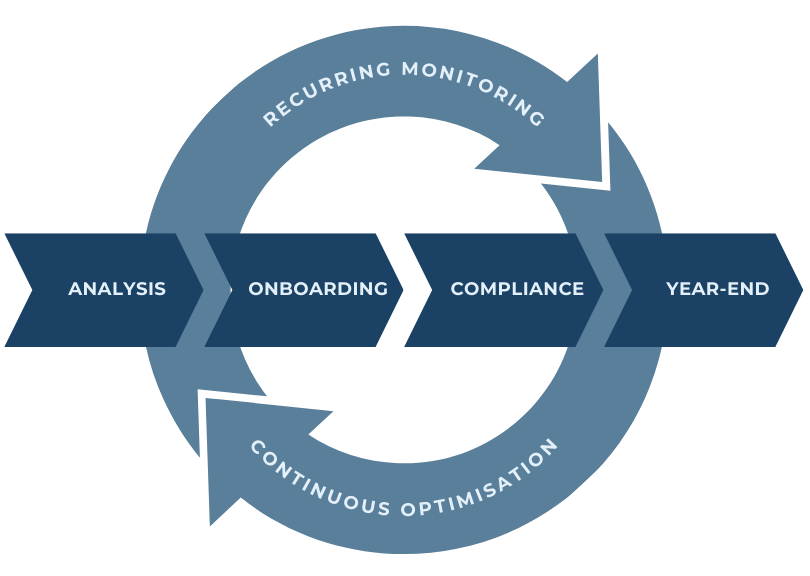

While the new Øresund Agreement makes managing cross-border employees significantly less complex, handling tax compliance, payroll, and employee benefits across multiple jurisdictions can still provechallenging. ‘The Crossbord® Solution’ is perfect for such cases. This solution involves the following steps:

- We evaluate whether the employee(s) can apply the Cross-border Agreement, and we clarify your obligations as an employer when the employee(s) can and cannot apply the Cross-border Agreement.

- We onboard the employee(s) into the Danish tax system and provide a comprehensive briefing about the Danish tax system to ensure the employee feels secure about their tax situation.

- We assist you, as an employer, with the necessary updates and amendments to your payroll process, depending on the outcome of the tax evaluation.

- We provide year-end tax support for the employee(s) to ensure they have paid the correct taxes in both Denmark and their home country.

The Crossbord® Solution offers comprehensive payroll and compliance services tailored for companies with employees who live and work across national borders. For Danish and Swedish businesses, Crossbord ensures that all payroll functions, tax withholdings, and benefit contributions are accurately processed in accordance with the new Øresund Agreement. Additionally, Crossbord acts as a bridge between you, your employees, and tax authorities, facilitating the necessary complex reporting so that you can avoid the submission of individual tax returns for each cross-border employee.

By partnering with Crossbord, you can streamline your administrative processes, reduce the risk of non-compliance, and focus more on your core operations while ensuring that your cross-border employees are properly compensated and taxed. This service is particularly beneficial if you have a large number of employees regularly commuting between Denmark and Sweden or engaging in remote work.

Get the

Crossbord®

Solution

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.