Tax Compliance for Foreign Employees

Moving to Denmark can be hard

Moving to Denmark can be a challenging experience for employees, involving numerous tasks such as finding a new home, relocating belongings, securing school or daycare for children, enrolling in language courses, and managing complex tax situations. Crossbord’s Foreign Employee Solution is designed to alleviate one major headache: tax compliance for foreign employees.

This service ensures that employees meet all their obligations towards the Danish Tax Agency, offering peace of mind and a favourable price.

The crossbord foreign employee solution

Basic

Review: Crossbord reviews the information to be filed for your employee.

Confidence: Your employee feels confident handling their taxes themselves.

Guidance: Walkthrough of year-end statement.

Advanced

- Assistance: Crossbord assists in the process for your employee.

- Partial Involvement: Your employee would like to do some of the work themselves.

- Assurance: Your employee gets assurance that the necessary information is filed correctly.

Premium

- Full Management: Crossbord takes charge of the entire process for your employee.

- Minimal Involvement: Your employee would like to be minimally involved.

- Professional Handling: Your employee wants to have everything handled by a professional.

employee benefits

- Tax Compliance for Foreign Employees: Ensures all obligations towards the Danish Tax Agency are met.

- Cost-effective: Offers a favourable price.

How does it work?

- Payment: Employees pay for the chosen service through a deduction in their net salary.

- Direct Contact: Crossbord will be in direct contact with your employee, eliminating the need for your company to act as a middleman in distributing information or answering questions.

Understanding the Danish income tax cycle

What is it?

preliminary income assessment (forskudsopgørelse)

The preliminary income assessment is the Danish Tax Authority’s calculation of your income for the coming year and how much you should pay in taxes.

- Budget

- Relevant for the coming year

- Can be adjusted throughout the year

Tax Return (Årsopgørelse)

Your financial statement for the previous year, showing how much you have actually earned and paid in taxes.

- Financial statement

- Relevant for the previous year

- Settled once a year

key dates: What happens when?

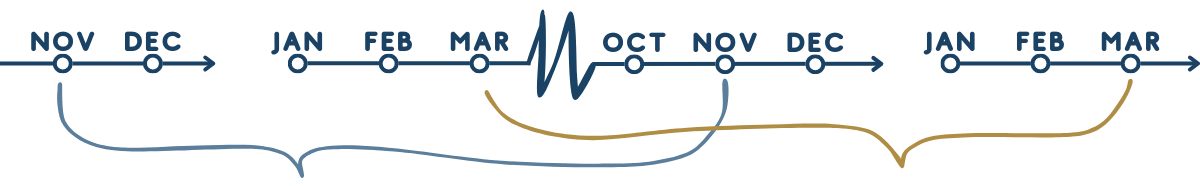

preliminary income assessment

You can see your preliminary income assessment on skat.dk/tastselv every year mid-November.

Tax Return

You can see your tax return on skat.dk/tastselv every year mid-March.

preliminary income assessment

Adjust your preliminary income assessment when it becomes available, or if you:

- Get a salary raise / decrease

- Have days working from home

- Obtain a loan

- Start / close down a company

Tax Return

Check your tax return to see if you get money back or need to pay residual tax:

- Double check that your information is correctly reported

- Make changes if your information is not correct

Get year end assistance

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.