Making International Tax Relief Simple:A Guide for Global Employers

When businesses operate across borders, one of the most pressing challenges they face is navigating the labyrinth of international taxation. Ensuring employees are not doubly taxed, managing compliance, and understanding the impact on operations requires clear strategies. This guide simplifies the complex landscape of international tax relief methods, focusing on practical solutions and how they influence global projects.

Understanding the Foundations of Tax Relief

Double taxation arises when an employee’s income is taxed both in the country where it is earned (source country) and in their home country (residence country). To prevent this, tax treaties and domestic regulations establish relief methods. For employers, these are not just administrative tools but crucial levers for maintaining compliance, ensuring employee satisfaction, and facilitating seamless project execution.

Exploring the Main Tax Relief Methods

Exemption with Progression

This method exempts foreign income from taxation in the residence country but includes it when determining the tax rate for other income. For example, a Danish employee earning DKK 300,000 in Germany pays tax only in Germany, but their Danish tax rate on domestic income considers the total earnings. This ensures progressive taxation fairness without double taxation.

Exemption without Progression

Under this approach, foreign income is entirely excluded from residence-country taxation and does not influence the rate for other income. For instance, if a Swedish employee earns income abroad, that income is ignored entirely in domestic tax calculations. While simpler, this method is less commonly applied and often subject to specific treaty agreements.

Credit Method

The credit method involves taxing global income in the residence country while granting a credit for taxes paid in the source country. Suppose an employee pays 15% tax on income in the source country, while their residence country’s rate is 20%. In that case, a credit offsets the 15%, leaving 5% to be paid domestically. This method is widely used but demands precise documentation and treaty-specific knowledge.

Matching Credit

Here, the residence country provides a hypothetical credit as if full tax were paid in the source country, even if the source country offers incentives or reductions. This is common where jurisdictions collaborate to promote economic activity without penalising taxpayers benefiting from tax incentives.

Reversed Credit

In a less conventional approach, the source country provides a credit for taxes paid in the residence country. For example, an employee taxed at 10% domestically and 15% in the source country might see the source country credit the domestic tax, leaving only 5% due there. This method requires careful navigation of bilateral agreements.

Deduction Method

Rather than providing a direct credit, this approach treats foreign taxes as deductible expenses in the residence country, reducing the taxable income. While administratively simpler, it typically offers less financial relief and is often used as a fallback when other methods are inapplicable.

Why These Methods Matter for Employers

For businesses, understanding and applying these methods is essential to safeguarding operations and managing costs. Compliance errors can lead to penalties, audits, and delays, potentially derailing projects. Additionally, employees expect their tax affairs to be handled competently. Missteps can cause dissatisfaction and erode trust.

Administrative complexity is another factor. International tax treaties vary widely, and ensuring accurate application requires expertise. By addressing these challenges proactively, employers can avoid disruptions and maintain competitive advantage in global markets.

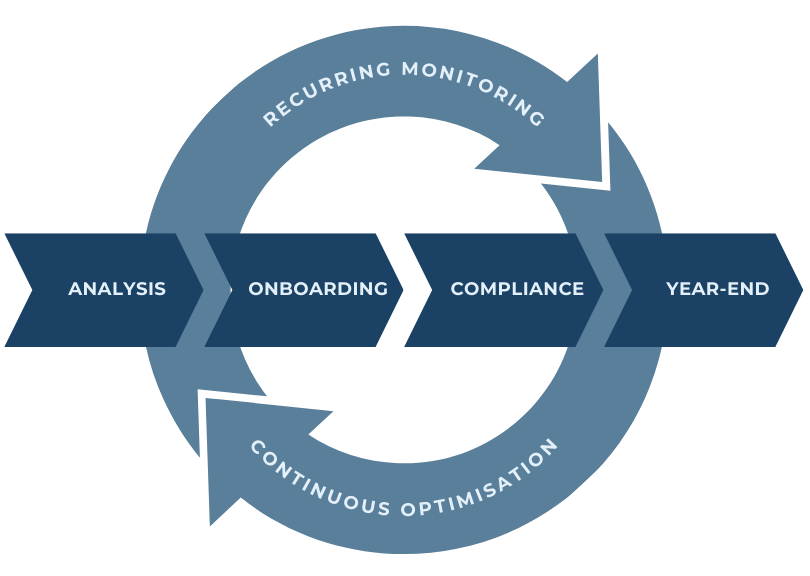

How The Crossbord Solution Supports Employers

Crossbord offers end-to-end support tailored to the unique challenges of international taxation. A cornerstone of this is our Year-End Reconciliation Service, which ensures accurate application of tax relief methods for employees working across borders. This service reviews and reconciles tax obligations annually, ensuring compliance with international agreements and optimising relief mechanisms. By managing year-end adjustments and verifying correct deductions, we eliminate uncertainties and prevent unnecessary tax filings for employees.

With The Crossbord Solution, businesses can:

- Ensure accurate compliance across jurisdictions, avoiding costly errors.

- Maximise the benefits of tax relief methods while minimising administrative burdens.

- Act as a seamless link between employers, employees, and tax authorities, eliminating unnecessary complications.

- Focus on core business objectives, knowing that tax compliance is expertly managed.

avigating international tax relief doesn’t have to be overwhelming. By understanding the methods available and partnering with experts like Crossbord, employers can simplify the complex, ensure compliance, and maintain smooth operations. Whether you need clarity on tax treaties or a complete compliance solution, Crossbord is here to help.

How The Crossbord Solution Supports Employers

Crossbord offers end-to-end support tailored to the unique challenges of international taxation. A cornerstone of this is our Year-End Reconciliation Service, which ensures accurate application of tax relief methods for employees working across borders. This service reviews and reconciles tax obligations annually, ensuring compliance with international agreements and optimising relief mechanisms. By managing year-end adjustments and verifying correct deductions, we eliminate uncertainties and prevent unnecessary tax filings for employees.

With The Crossbord Solution, businesses can:

- Ensure accurate compliance across jurisdictions, avoiding costly errors.

- Maximise the benefits of tax relief methods while minimising administrative burdens.

- Act as a seamless link between employers, employees, and tax authorities, eliminating unnecessary complications.

- Focus on core business objectives, knowing that tax compliance is expertly managed.

Read more about The Crossbord Solution

The Crossbord® Solution

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.

How The Crossbord Solution Supports Employers

Navigating international tax relief doesn’t have to be overwhelming. By understanding the methods available and partnering with experts like Crossbord, employers can simplify the complex, ensure compliance, and maintain smooth operations. Whether you need clarity on tax treaties or a complete compliance solution, Crossbord is here to help.