Year-End Reconciliation Guide for Cross-Border Compliance

Avoiding Costly Surprises with Structured Reconciliation

At the close of each year, companies turn their attention to reporting, audits, and compliance reviews. For businesses with international employees, year-end reconciliation is more than just a formality – it’s a critical process to ensure tax and social security compliance across borders. Failing to address discrepancies now can lead to costly surprises in the form of back taxes, penalties, and strained employee relations.

Many companies mistakenly believe that if everything appeared to run smoothly throughout the year, there’s no need for additional checks. The reality, however, is that minor oversights can compound over time, only surfacing during audits or tax reviews. By conducting a structured reconciliation process at year-end, companies can safeguard their operations and avoid unnecessary exposure.

Common Challenges in Year-End Reconciliation

Why Year-End Reconciliation is Essential

Cross-border operations inherently introduce complexity. Employees may travel between countries, tax regulations evolve, and social security obligations shift. Throughout the year, payroll continues, but the alignment between payroll, tax, and social security doesn’t always follow suit.

Year-end reconciliation provides an opportunity to audit and align these elements, ensuring that:

– Tax is accurately reported and paid in the correct jurisdictions.

– Social security obligations are met, and employees remain covered.

– Payroll reflects bonuses, allowances, and tax relief schemes that may have changed.

– The need for individual tax returns is minimized by ensuring accurate employer reporting from the outset.

For companies managing international teams, reconciliation is not just about fixing errors – it’s about preventing future liabilities and maintaining seamless operations.

The Crossbord Solution for Seamless Compliance

Eliminating the Need for Individual Tax Returns

One of the key advantages of The Crossbord Solution is that it eliminates the need for employees to file individual tax returns for matters that can be handled directly by the employer.

By ensuring that all relevant income, benefits, and allowances are accurately reported through employer submissions, Crossbord reduces the administrative burden on employees and minimizes the risk of errors. In cases where further clarification is required by tax authorities, our service ensures that an explanatory letter and supporting documentation are prepared and submitted, preventing unnecessary follow-up from employees.

This process not only streamlines compliance but also enhances employee satisfaction by removing the complexity of filing tax returns across multiple jurisdictions.

Hypothetical Cases: Addressing Hidden Tax Liabilities Through Reconciliation

Case 1: Unexpected Tax Liability Due to Shifted Residency

Consider a scenario where a company hires an international specialist under a net salary agreement, assuming the employee’s tax obligations would align with their home country. However, during year-end reconciliation, it is revealed that the employee’s tax residency shifted due to extended stays in Denmark, triggering full tax liability under Danish rules. As the employee was on a net salary, the employer had to cover the unexpected tax difference. This discrepancy resulted in a significant additional cost, which could have been avoided if the employee’s tax position had been monitored throughout the year.

Case 2: Double Taxation Despite Double Taxation Agreements (DTA)

In another case, imagine a company seconding employees to Sweden for a long-term project. Throughout the year, payroll assumed that double taxation agreements (DTA) would prevent dual taxation. However, during reconciliation, it was found that one employee exceeded the threshold for tax residency in Sweden, resulting in double taxation. By filing corrective reports under the DTA, the employer avoided the need for the employee to file an individual tax return, ensuring compliance and reducing administrative burdens.

Proactive Year-End Reconciliation

Expert Guidance in International Tax and Social Security Compliance

At Crossbord, we specialise in guiding companies through the complexities of international tax and social security compliance. With extensive experience managing global employee mobility, our year-end reconciliation process is designed to eliminate compliance gaps and provide peace of mind.

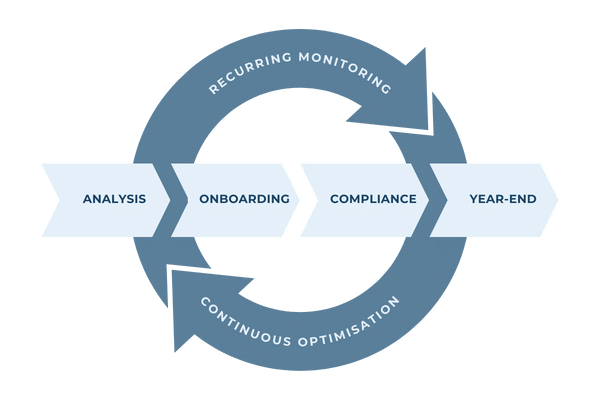

Seamless Integration with Continuous Monitoring

For companies already using The Crossbord Solution, reconciliation is not an isolated process but a seamless extension of continuous monitoring. Throughout the year, our team tracks employee status, payroll updates, and tax obligations, ensuring that year-end checks are smooth and efficient.

Year-End Reconciliation Checklist

critical checks for annual tax reporting

- A1 certificate and social security alignment

Ensure certificates are valid until year-end and employees are under the correct social security scheme. - Salary, bonuses, and benefits reconciliation

Verify accurate reporting of all taxable income across jurisdictions. - Assessment of permanent establishment (PE) triggers

Review employee presence abroad for potential PE tax liabilities. - Expat tax schemes and allowances

Confirm registration for expat tax schemes and ensure income thresholds are met. - Employer-led year-end tax reporting

Submit corrective employer filings and prepare explanatory letters if required.

Get more information

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.