The RUT Register: Compliance for Foreign Service Providers

What is the RUT-register?

The Register for Foreign Service Providers (RUT) is a cornerstone of Denmark’s efforts to ensure that foreign companies operating in the country comply with legal requirements concerning labour rights, tax obligations, and occupational safety. It is a mandatory registration for foreign service providers who temporarily deliver services in Denmark, including both companies with employees and self-employed individuals in certain high-risk sectors. Therefore, RUT register compliance is essential for foreign service providers operating in Denmark.

The RUT’s primary purpose is to provide Danish authorities with the necessary information to monitor and inspect foreign companies and their workers to ensure that they are operating under lawful conditions. By centralising this information, the RUT facilitates cooperation between various government agencies such as the Labour Inspectorate, the Tax Authorities, and SIRI (the Agency for International Recruitment and Integration), which are tasked with enforcing Danish laws on foreign workers.

How the RUT-register Works

The process of registering in the RUT is straightforward but requires the submission of detailed information about the foreign company’s activities in Denmark.

This information is essential to allow the authorities to oversee compliance and includes:

The name, legal form, and contact information of the company, as well as its address and tax registration number from the home country.

Specific details about the type of services being delivered, the start and end dates of the project, and the geographical location of the work in Denmark.

If the foreign company is employing workers, it must provide detailed information about the employees working on the project, including names, job roles, and details about social security coverage in their home country.

If the foreign service provider is working for a Danish contractor or client (other than a private individual), details about the Danish contracting entity must also be included.

This information must be submitted to the RUT at least by the day the work begins in Denmark, and any changes (such as the addition of new employees or changes to project details) must be updated in the register by the next business day. Failure to do so can result in fines and other penalties.

Recent Legislative Changes: Strengthening Oversight Through Bill L 15

In light of growing concerns about illegal employment practices and social dumping, the Danish government introduced Bill L 15 in October 2024, which proposes several important amendments to the existing RUT regulations. These changes are designed to improve transparency and strengthen the ability of Danish authorities to enforce labour laws for foreign workers, particularly those from third countries.

Importance of RUT for Companies and Workers

For foreign companies, registering in the RUT is not just a bureaucratic obligation; it is a legal requirement that can have serious consequences if ignored. Danish authorities have the power to inspect worksites and verify whether all foreign workers are properly registered and whether they have the appropriate legal documentation, such as valid work permits for third-country nationals. Fines for non-compliance can be substantial, and repeat offences can lead to even more severe penalties, including restrictions on future work in Denmark, therefore all foreign service providers in Denmark must comply with the RUT register.

For workers, the RUT serves as a protective mechanism, ensuring that they are not exploited or subjected to unfair working conditions. By centralising information about foreign service providers and their employees, the RUT enables authorities to take action if workers are found to be underpaid, working without proper safety equipment, or employed without the correct legal documentation.

New Documentation Requirements for Third-Country Nationals

The most significant change introduced by Bill L 15 is the requirement for foreign service providers who employ third-country nationals to submit additional documentation when registering in the RUT. These companies must now upload:

- The service contract between the foreign company and the Danish client.

- Employment contracts for all third-country nationals working on the project.

- Valid residence and work permits for these workers.

This new requirement aims to provide the Danish authorities with a clearer picture of the legal status of third-country nationals employed in Denmark, making it easier to verify that these workers are legally allowed to reside and work in the country.

Identification Requirements During Inspections

The second major change proposed in the bill relates to the identification of workers during inspections. Under the new rules, every worker employed by a foreign service provider in Denmark must be able to present valid identification when requested by Danish authorities. This includes not only Danish residents but also workers from other EU countries and third-country nationals.

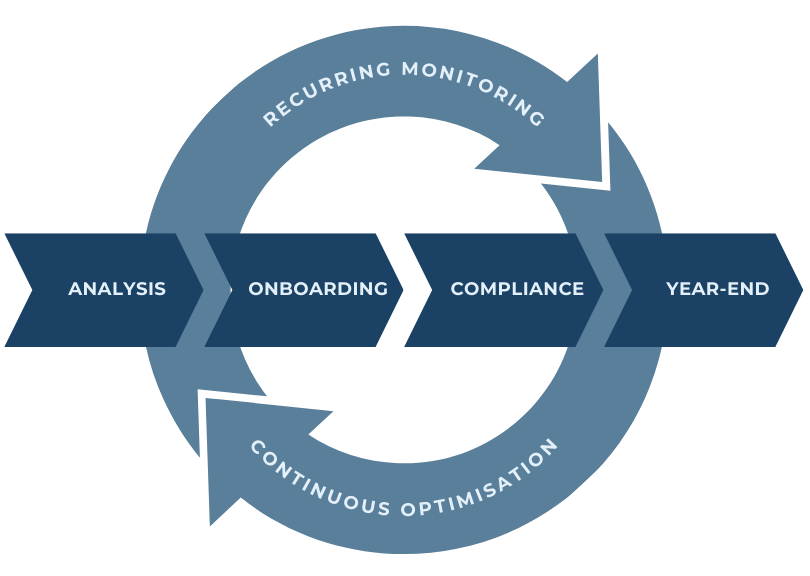

The Crossbord Solution: Ensuring Compliance for Companies Operating Cross-Border

Navigating the complexities of Danish labour law and the new RUT requirements can be challenging, particularly for companies that are already dealing with the logistics of cross-border operations. This is where Crossbord provides invaluable support.ng the entire RUT registration process on behalf of your company.

Through The Crossbord Solution, we offer end-to-end compliance services, ensuring that your company meets all Danish legal requirements related to cross-border employment. Our services include:

- Handling the entire RUT registration process on behalf of your company.

- Ensuring that all necessary documentation for third-country nationals is uploaded correctly and on time.

- Managing payroll, tax filings, and social security contributions to ensure full compliance with Danish regulations.

- Assisting with legal inquiries or inspections from Danish authorities, including the Labour Inspectorate and tax authorities.

Ensuring Compliance with the RUT-register: Your Key to Success in Denmark

The RUT-register is an essential tool in Denmark’s regulatory framework, designed to protect workers, ensure fair competition, and uphold the integrity of the Danish labour market. With the new legislative changes introduced in Bill L 15, compliance has become even more critical for foreign companies operating in Denmark. These changes represent a significant tightening of the rules, particularly for companies employing third-country nationals, and highlight the Danish government’s commitment to fighting illegal employment and social dumping. Therefore, adhering to RUT register compliance is crucial for all foreign service providers in Denmark.

At Crossbord, we are committed to helping businesses navigate these changes and ensure full compliance with Danish law. Whether you are a foreign company seeking to register in the RUT or a Danish business working with foreign service providers, we are here to support you with expert advice and practical solutions.

Contact us today to learn how we can help you stay compliant and maximise your operational efficiency in Denmark.

RUT-register Assistance

* By checking GDPR Consent, you agree to let us store the information you provided in our system. You can always contact us to permanently remove your data.